Construction

- Deloitte’s Winter 2022 London Office Crane Survey revealed the volume of new starts increased slightly compared with the last (six-month) survey period but remains below the 10-year average. Refurbishment work was the main driver behind this rise, representing over two-thirds of the volume (in sq ft) started.

Source: Deloitte

Some key highlights from the latest report include:

- A complete absence of larger builds (over 300,000 sq ft) over the past year as ESG considerations have made local authorities less likely to grant future demolition permits as well as concerns about the relative risk of new build projects compared to refurbs as the economic picture darkens

- Developers expect the shift to hybrid working to drive down the overall requirement for office space by 10% per head in the long term. But a tilt to refurbishment and 'flight to quality' will drive stronger demand for Grade A space

- London office development pipeline forecast to grow in 2023 due to post-pandemic catch-up on completions

- Volume of space completed in the latest (six-month) survey period recovered strongly, rising by 71% from 1.74 million sq ft to 2.98 million sq ft. However, completions were expected to be even higher at 4.0 million suggesting that projects will be pushed into 2023 due to disruption caused by material shortages and supply chain failures

- Both UK construction output and new orders defied the economic slump in Q3 and expanded by 0.6% and 6.4% respectively against the previous quarter. Output hit a new record quarterly high, making it the odd one out of the UK’s major sectors which all stagnated in Q3. Construction’s output figures show that demand remained resilient right up until the turmoil of September 2022, providing a good foundation for the industry to enter an economic slowdown. New order data also suggests that order books currently remain strong. However, not all sectors fared well in Q3 in terms of new work growth with the most notable contractions coming from the residential sector (-5.8%). The spike in new work is unlikely to mark the start of a sustained upward trend as weakening demand is starting to squeeze the pipeline of new construction work. Waning sentiment in the wider economy, rising interest rates and high construction costs have the reduced medium-term prospects for new work growth.

Source: ONS

- The recent Autumn Statement saw the Government reiterate its commitments to proceed with major infrastructure projects such as Sizewell C, HS2 and Northern Powerhouse Rail. More than £600bn of capital investment on projects such as the New Hospitals Programme over the next five years will be safeguarded. Other measures announced included time-limited increases to stamp duty thresholds which will do little to help the flagging residential market or prop up housebuilding activity in light of more prevalent headwinds. Plans for ‘Investment Zones’ - geographical areas with reduced planning regulation and lower taxes to boost growth – will go ahead but will be focused on “left behind areas” to build clusters of growth to leverage local research strengths. Generally, increases in department spending already set out will be maintained but efficiency savings to compensate for inflation will have to be made, according to the Government. Finally, the Government will seek to “accelerate the delivery of infrastructure projects” across the infrastructure portfolio and invest at least £1.7bn in local projects as part of the second round of the Levelling Up Fund.

- RIBA’s Future Trends index fell a further three points in October. It now stands at -20, reflecting a drop in architects’ confidence with regards to upcoming workloads. Just 12% of practices expect workloads to increase in the coming three months while 56% expect no change. One-third, however, expect workloads to decline. All sectors saw falls in confidence, but it was the public sector that dropped the most last month. Smaller practices were the most worried about declining workloads while medium and larger practices returned scores in positive territory. London remains the most pessimistic, posting a balance score of –32, down from –23 in September with 40% of London-based practices now expect workloads to fall. Despite the index’s drop, head of economic research and analysis at RIBA said the pessimism about future workloads has not resulted in widespread anticipation of job losses, noting that:

“In our post-Brexit environment, qualified, talented architectural staff are hard to recruit and retain. So far practices are, overall, seeking to keep staff.”

- The latest Government insolvency statistics indicate that 308 construction firms became insolvent in September 2022 – 27% lower than March’s recent high of 420 insolvencies but some 205% higher than the recent low in August 2020 of 101 insolvencies. So far, in the year to September 2022, 3,953 construction firms became insolvent, the highest number since the financial crisis. Most of the firms that went out of business in the year to September were ‘specialist contractors’ (59%). This is largely due to the fact they are often on fixed price contracts signed more than a year ago (prior to the recent spikes in energy and materials prices). Rising labour costs, IR35, reverse charge VAT, removal of the red diesel rebate and rising Professional Indemnity Insurance costs are also factored in. Meanwhile, only 6% of insolvencies were civil engineering firms, which have been less affected due to strong infrastructure workloads and new order growth from major projects and frameworks activity. Also, clients and main civils contractors have typically been understanding of input cost inflation related pressures and less stringent in enforcing fixed-price contracts.

Source: The Insolvency Service

- New construction minister Nusrat Ghani is the fourth person in the role this year following the departure of Jackie Doyle-Price, who left earlier this month after having spent just two months in the role. As construction minister, she will be the industry’s main point of contact with the Government and will co-chair the Construction Leadership Council with Mace chief executive Mark Reynolds. The role of Housing Minister has seen a similar turnover of late, with Lucy Frazer MP recently becoming the fifth housing minister in 2022, replacing Lee Rowley (who lasted just 48 days). Given how important the construction industry and housing market is to the UK economy, levelling up and Net Zero, many have found the constant change unsettling.

Client & Contractor News

- In a statement accompanying its half-year results, British Land said that some investors had put on the brakes on London office schemes following September’s mini-budget. Rising interest rates and inflation have also led to postponed decision-making and more subdued investment markets. However, British Land did note that despite the unclear outlook, certain investors are actively looking to allocate capital to physical real estate. The firm said it will submit plans this month to turn 5 Kingdom Street at its Paddington Central development into a £400m, 127,000 sq ft underground urban logistics hub with a further 211,000 sq ft office space above it. It also intends to submit plans to overhaul the 1960s Euston Tower next year which it said, “will include a substantial amount of lab enabled space leveraging its location in London’s Knowledge Quarter”.

- Wrexham Council has given unanimous support for the replacement of a decommissioned football stand last used in 2010. Club owners, Hollywood stars Ryan Reynolds and Rob McElhenney, can now push forward with the plans to add 5,500 seats to Wrexham AFC’s Racecourse Ground. The stand will include a hospitality lounge, offices and retail space for the club, together with facilities for the Wrexham AFC Community Trust. G&T is providing Cost Management, Project Management and Principal Designer services on the project.

- In order to meet its ambitious embodied carbon targets and transition to net zero, Landsec has joined the Climate Group led initiative ‘ConcreteZero’, committing to buy and use 30% low emission concrete by 2025, 50% by 2030 and 100% net zero concrete by 2050. Landsec is building on its ‘SteelZero’ commitment to help speed up the net zero transition of steel and, combined with its recent commitment to become a ConcreteZero member, decarbonise what are two of the most energy intensive industries. Members play a key role in accelerating the use of sustainable materials within its sector, influence the use of sustainable materials across its growing real estate portfolio. Jen Carson, head of industry at Climate Group said:

“They're leading the charge to support decarbonisation of two of the most energy intensive industries. With steel and concrete production contributing to 15% of global annual carbon emissions, it's hard to over-emphasise the importance of these industries reaching net zero fast."

- Sellar, developer of the Shard, intends to submit plans to redevelop Liverpool Street Station – one of the capital’s busiest train stations – by April next year. The developer is working with Network Rail to create approximately one million sq ft of mixed-use space at the site as well as revamping the station. The upgrades will see concourse space doubled, an increase in the number of lifts, escalators and ticket barriers, as well as new public realm and green space. The plans by Sellar include removing the 1980s roof and station entrance and constructing a 10-storey hotel and office block. Work is set to start in the second half of next year with the job expected to complete in 2029. G&T is providing Project and Cost Management services on the project.

- Steelwork contractor Severfield has announced that its revenue was up 20% (to £234.9m) in the first six months of trading in 2022. This follows a record-breaking 12-month period last year which saw income top £400m for the first time ever. The firm’s pre-tax profit was also up by 29% to £10.2m which it noted:

“…highlights our ability to offset ongoing inflationary cost increases through a combination of operating efficiencies, higher selling prices and contractual protection as steel remains largely a pass-through cost for the group”.

The firm, which is involved in projects ranging from Everton’s new football stadium in Liverpool to new studios for broadcaster Sky in Hertfordshire, noted profits have been powered by soaring steel prices and increased business activity. Higher inflation has driven up costs across the supply chain but also the revenues the company can generate. Despite the difficult macroeconomic backdrop, the company’s outlook for the UK and Europe remains bullish, with tendering and pipeline activity remaining at consistently high levels. The group’s UK and Europe order book currently stands at £464 million, helped by opportunities in the industrial and distribution, transport infrastructure, nuclear, data centre and commercial office sectors.

Materials & Commodities

- Brickmaker Forterra has increased its brick prices by double digits three times so far in 2022 – 16% in January, 12% in April and a 16.5% rise in October – and has warned of a further price hike at the beginning of 2023. Cumulatively, the cost of Forterra’s bricks has risen by 44.5% with the manufacturer explaining its need to “…act decisively to recover ongoing cost inflation…”. In its latest trading update, the firm confirmed revenues were up 23% in the 10 months to the end of October 2022 compared to last year. Forterra has secured almost 90% of its energy requirement for the remainder of the year and 60% of its 2023 gas requirement which will help hedge against further energy price volatility.

- The latest producer price inflation (PPI) statistics from the ONS show that the rate of input price inflation (ie the prices of materials and fuels purchased by manufacturers) and output price inflation (ie factory gate prices – the price paid to producers by distributers/wholesalers) continues to slow but still remains high. Producer input prices rose by 19.3% in the year to October 2022, while producer output prices rose 14.8% over the same period. The annual rate of input PPI has now been positive for 23 consecutive months, although it has slowed for the fourth consecutive month and is down 5 percentage points from the record high of 24.2% in June 2022. The annual rate of output PPI has now been positive for 22 consecutive months but slowed for the third consecutive month. According to the ONS, inputs of crude oil and chemicals all provided downward contributions to the change in the annual rate of input inflation, but these were offset slightly by positive contributions from both fuel and food.

Source: ONS

- In addition to slowing rates of PPI, a number of other key indicators suggest global inflation has peaked. Commodity prices (according to the representative GCSI index) have fallen by more than 26% since peaking in June. Shipping rates have also declined significantly according to indices such as the Baltic Dry Index and are now near their pre-pandemic levels. Following an easing of price pressures for most commodities and supply delivery bottlenecks, economists now expect headline inflation to begin to fall next year as demand weakens. However, some caution that continued high energy costs could slow the decline. Oil is set to stay highly sensitive supply chain constraints (and the looming EU ban on Russian crude), while the potential for further Russian export cuts in retaliation to western price caps on its oil and gas could see energy prices jump once again. In additional, energy and commodity prices could also rise if the Chinese economy makes a strong recovery.

- G&T’s soon-to-be published M&E contractor survey report has unveiled material availability issues are ongoing. Contractors reported the war in Ukraine has had a notable impact on M&E materials (both from a reduced availability perspective as well as an energy-driven inflation perspective). Rising energy costs have increased the cost to manufacture M&E components, while certain resources from Russia/Ukraine have become unavailable and need to be sourced elsewhere. Another factor affecting the availability and delivery of M&E products are the stringent/ongoing Chinese lockdown policies. This is pushing lead times higher, particularly for products with microchips, large plant (eg ASHP, AHUs), switchgear, generators, chillers and several other items. The full report will be published on G&T’s Market Intelligence site in the coming days.

UK/Global Economy

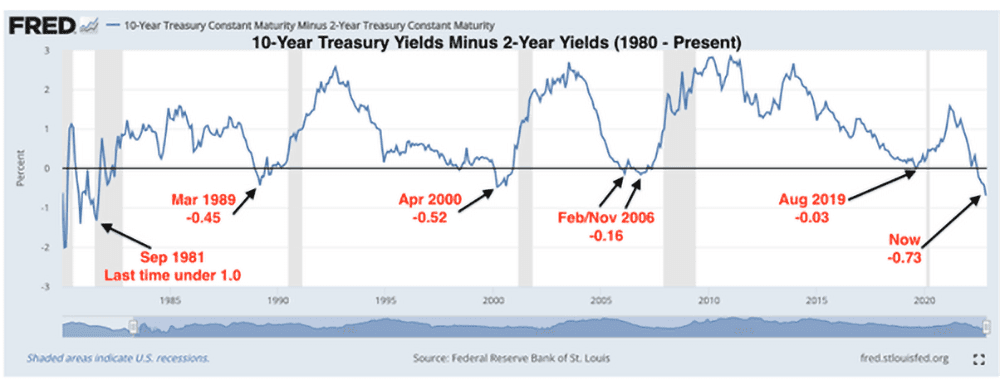

- Despite some signs of peaking inflation, one of the best-known predictors of recession suggests there is trouble ahead for the US economy. Known as an inverted yield curve – a state in which longer-term (10-year) bonds have a lower yield than short-term (two-year bonds) – this leading indicator has been a strong predictor of recessions and when this dynamic has been in place over the last two decades, in each case a recession has followed. Most of the time, yields on longer maturities are higher than yields on shorter-dated bonds, which reflects the greater risks of holding bonds for longer periods of time. While an inverted US Treasury yield curve isn’t known as a predictor of how deep or how long a recession may last, or even when a recession will begin, market watchers say the current message is unmistakable. Although the yield curve has been inverted for a while, it recently moved to its most extreme since 1982 due to a big drop in long-term bond yields.

Source: Seeking Alpha

- The OECD has warned the UK’s growth prospects are the worst among the top (G20) economies bar Russia over the next two years. In its latest economic forecasts, the OECD said UK GDP would fall 0.4% in 2023 and rise a mere 0.25% in 2024. This represents a longer and deeper downturn than many other developed economies, including Germany, whose manufacturing-intensive economy is particularly vulnerable to high energy prices. The body explained that the economic adjustment currently underway in the UK would compound longstanding concerns about the country’s low productivity. A lack of progress on post-Brexit trade deals, artificial and untargeted energy price caps and concerns that higher costs of capital would continue to weigh on investment fed into the UK’s outlook. It was also suggested that acute labour shortages could “force firms into a more permanent reduction in their operating capacity or push up wage inflation further”.