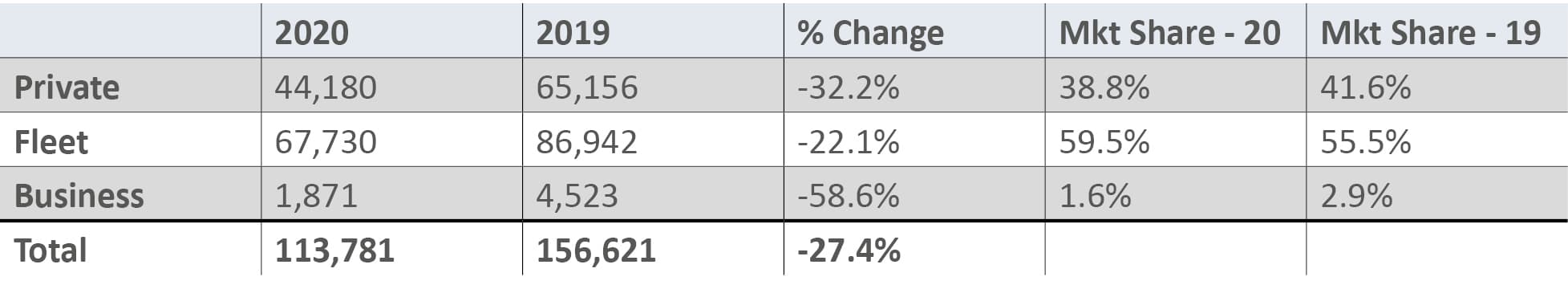

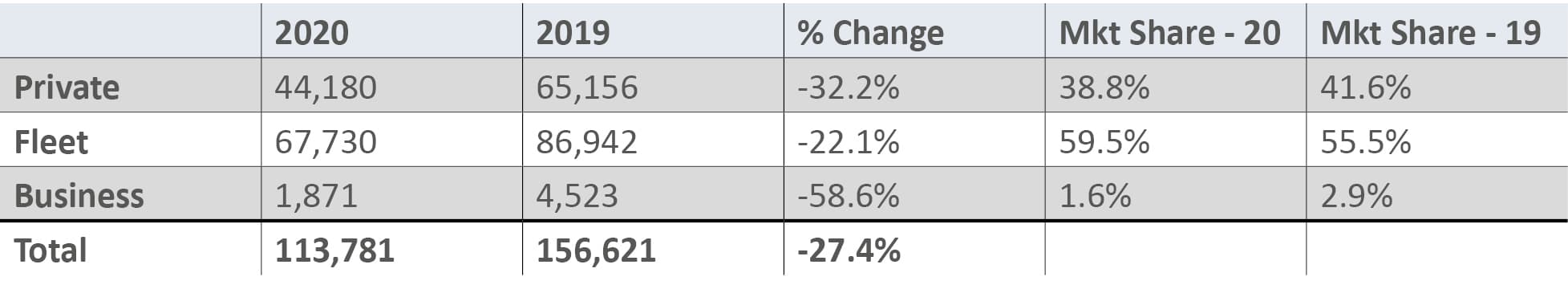

You need look no further than the data provided by the Society of Motor Manufacturers and Traders (SMMT) to appreciate the impact that COVID-19 (and to a certain extent, Brexit) has had on the UK automotive sector.

New car registrations in the UK have been declining on an annual basis since 2016. In the year to November 2020, registrations have fallen 30.7% compared to the previous period (ie the year to November 2019). UK lockdowns have evidently put a damper on both demand and sales as showrooms were forced to close for several months of the year.

Despite the significant fall in car registrations this year, there is still a huge market and private vehicle sales are forecast to bounce back as dealers look to recoup some of the earnings lost during 2020.

Source: SMMT

The core product is changing rapidly

As has been established in previous articles in our EV series and as evidenced in the table below, the number of new registrations for Petrol and Diesel vehicles are declining rapidly. Meanwhile, new registrations of Battery electric vehicles (BEVs) are growing faster than ever. BEV registrations are up 162% in the year to November 2020 whereas petrol and diesel registrations have fallen by 39% and 55% respectively.

If these current trends continue, BEV sales could overtake petrol and diesel sales by the end of 2021[1]. Next year will be crucially important in terms of understanding consumer appetite for BEVs and whether the rise in sales be sustained.

Source: SMMT

In Europe, new mandatory emission reduction targets for new cars will be implemented in 2021, bringing penalties to manufacturers who exceed the targets. Measures like this, which have been taken to address the air pollution crisis, will inevitably shape Original Equipment Manufacturer (OEM) strategy and benefit EV sales growth. The UK Government recently brought forward its ban on the sale of petrol and diesel powered vehicles to 2030. Although several manufacturers have already committed to ending pure-internal combustion engine (ICE) sales before 2030, this is likely to accelerate EV sales growth in the UK.

According to a recent study, one in four cars produced in Europe will be fully electric by 2025 and European factories will produce more than two million electric cars annually within five years[2]. So it is clear that EVs are the future, but the how will the retail and sales process adapt?

Will traditional OEMs move quickly enough?

The move towards EVs, whether it be BEVs, plug in hybrid electric vehicles (PhEVs), hybrid electric vehicle (HEVs) or mild hybrid electric vehicles (MHEVs), has created an opportunity for disruptors to enter the market. Disruptors are typically unconstrained by large property portfolios and existing sales networks, so have brought fresh thinking in terms of the route to market. Tesla’s recent success is testament to this. G&T’s recent experience and success in delivering new showrooms for an unnamed client has been the catalyst for this article. Our client is a new and exciting car brand that is set to launch in 2021.

Car dealerships such as Vertu Motors have reported that lockdowns have turbocharged online sales solutions. COVID-19 has acted as a catalyst for online sales and a number of dealerships have enhanced and simplified their online sales platforms in response.

“It will now be more vital than ever before to have an omni-channel approach offering choice to customers between online and offline channels. The customer experience of the transition from online to offline (and return) must be seamless.”

Increasingly, conventional dealerships will be looking to cut operational costs by using ecommerce platforms that can handle the sales function up to the point of handing over the vehicle. According to Auto Trader 76% of consumers looking to buy a car are anxious about visiting a dealership in person. Around half also said that they want minimal contact with a retailer. Although consumer attitudes are likely to change once the pandemic has passed, the fact is that people have become used to buying everything online. Retailers will inevitably have to place a greater focus on adapting forecourts to accommodate digital and remote selling.

Most experts believe that a combination of online and traditional sales will be the future. The physical experience is unlikely to become completely redundant and showrooms will still form part of the sales journey. Buyers will, however, expect a blended retail type sales model that allows them to seamlessly transition between online and offline experiences.

“Showrooms...will become the stage for the drama and excitement of a sales handover as opposed to the traditional site for doing the paperwork.”

The move to high footfall areas and specialist experience centres

The variety of different models on sale has increased significantly over the past 20 years. Hatchbacks, coupes, saloons, estates, crossover, SUVs and even coupe SUVs are just some of the options to choose from. Entirely new disruptor brands like Tesla, polestar and G&T’s undisclosed client have increased consumer choice further. With this increased choice, brands are having to compete harder and harder with each other to secure sales.

A number of OEMs are reinventing the offline experience by going to the customer instead of relying on the customer coming to them. They are creating spaces in high footfall areas such as high streets and in shopping centres. It is now commonplace that you can go to a shopping centre, purchase your weekly groceries, clothes and luxury jewellery alongside your new car. This was demonstrated by G&T’s recently completed project in New York. For details see here.

Locating brands in these retail spaces provides consumers with the opportunity to preview models or access brands that they are perhaps unfamiliar with or haven’t considered before. Offering an informal and non-pressurised platform, these spaces tend to focus more on brand experience instead of the hard sell. They are places to discuss the product, experience interactive technologies and engage with and promote the brand. Retail is undergoing a seismic shift at the moment with shopping centres becoming increasingly focused on providing unique and exciting experiences. Automotive pop-up stores and showrooms in these retail locations have grown significantly over the last five years because they provide brands with a unique opportunity to interact with visitors.

Tesla pioneered the concept of locating stores inside shopping centres, creating a retail space that is essentially a display. Other brands and OEMs have since taken Tesla’s lead. Indeed some, such as Ford and Mazda have gone one step further. In their interactive hubs, there are no physical vehicles to be seen at all. Interactions are digitised. Mazda’s pop-up virtual reality experience at intu’s Trafford Centre give people the chance to virtually drive a MAXDA MX-5 RF through the Italian Alps. These spaces help plug the gap between the brands online marketing and traditional dealerships and help to draw consumers one step closer to the brand.

Are we moving away from the franchised dealership model?

While physical franchised dealerships are likely to remain an essential element of the buying journey for the time being, OEMs are increasingly bringing control of the pricing, purchasing and payments in-house and away from franchised dealers. This strategy allows the OEMs to have one price for the same vehicle regardless of which outlet it is bought from, thus removing the process of “haggling” for the best deal and eliminating piece-based competition between dealers. This takes away the fear that consumers face when purchasing online, namely “am I getting the best deal?”

BMW has completed a pilot project that adopted this strategy in a bid to create a seamless brand experience across all channels – online and offline. Under the pilot model, which was undertaken by BMW’s subsidiary in South Africa, BMW took direct responsibility for the sale. It took the orders, generated the invoices and received payment. With BMW setting the price, dealerships could turn their attention from haggling over price and more towards demonstrating or explaining features of the vehicles – much like an Apple store concept, but for cars. BMW is considering stepping away from their old wholesale model and introducing similar distribution models in other markets as well[4].

Ten years ago, customers visited dealerships on average around seven times per vehicle purchase. Today, this number is around 1.5[5]. With the rise of digital experiences and enhanced visualisation technologies, the traditional dealership model has become less relevant. However, the spaces are still very much needed. Some brands believe that dealerships will need to transition from being the end point of a linear buying journey to become part of a set of inter-connected touchpoints for customers to utilise at any point in the journey. Under this model, dealers would need to reinvent and repurpose their space to become ‘experience centres’ – physical spaces where product experts or consultants add value by demonstrating vehicle technologies, provide test drives as well as physically handing over the vehicles. There is perhaps no greater experience centre than G&T’s recently completed project for Porsche Motorsport in North America. For details see here.

No single model will work for all customers and choice will be key. Although some consumers will feel comfortable with an entirely online sales process, most will still want places where they can go to touch, feel and test drive new vehicles before buying them. This is particularly true for EVs which incorporate technologies that many consumers are still unfamiliar with. In summary, there is a future of dealerships but their role is likely to change and move away from the traditional franchise dealer model and more towards delivering off-line experiences, demonstrations and test drives.

Automotive industry megatrends

According to McKinsey, the disruption of automotive retailing is just beginning and will accelerate rapidly in the coming years as a result of four automotive industry megatrends: autonomy, connectivity, electrification and shared mobility. In tandem, continued digitisation of the customer experience and dealership franchises, as well as the growing importance of omnichannel marketing, will put pressure on margins forcing the automotive ecosystem to introduce new business models.

While automotive e-commerce platforms will take business away from brick and mortar operations (McKinsey estimates that new car purchase journeys will shift to 10-25% digital while used cars increase to 25-50% digital), dealerships will be able to increase their chances of survival by optimising their footprint in light of these megatrends. The in-store experience needs to be improved by introducing greater digitisation and innovations such as virtual trade-in appraisals, scanning of customer ID on arrival for easy document preparation as well as some of the other innovations that have already been mentioned which will help engage a digitised customer-base.

There have always been challenges with franchised dealers implementing an OEM’s corporate identity, but a number of these challenges can be overcome by OEMs taking complete control and moving to a direct sales model. However, even then, there can still be difficulties communicating head office’s corporate identity to the local team delivering the spaces. G&T’s expertise in stakeholder management and communication ensures that this issue is minimised, as it has been for our undisclosed client.

Re-evaluating the automotive retail real estate

While we’ve established that dealerships and OEMs will need to make their physical retail spaces more digital, interactive and seamlessly integrated with their online strategies, what does this mean in terms of required space?

Online sales and remote deliveries will undoubtedly take away some of the need for physical automotive retail space. As online sales volumes rise, physical footprints are likely to shrink. Smaller showrooms may be needed as the focus becomes more on information sharing and interactive activities.

OEMs that decide to move away from franchised dealers and take a direct sales approach will inevitably need more retail space. But what kind of retail space will they need? OEMs are unlikely to want to invest in real estate that can hold high levels of stock like franchised dealers. The space they require is more likely to be small scale outlets in high footfall shopping centres and high street locations. These spaces are likely to be smaller than traditional show rooms as they will primarily be used as information centres to drive online purchases.

Bain & Company estimates that the number of cars sold at traditional brick-and-mortar dealerships in Europe will fall by 37% by 2025, leading to a consolidation of today’s dealership structures[6]. However, this does not necessarily mean there will be a 37% reduction in the amount of space dealerships require. Franchised dealerships will hope to develop new retail formats such as pop-up stores and experience centres in urban locations which will require new additional space. Many of their existing out-of-town locations will also remain to provide car-servicing facilities. However, as established in our previous EV articles, EVs require less maintenance and have fewer serviceable components so there is likely to be less need for real estate dedicated to servicing.

It remains to be seen how spatial requirements will change, but new and innovative retail formats look set to largely replace the traditional, full-service urban car dealership with extensive showrooms. To survive and prosper in these changing conditions, dealers and OEMs will need to adapt their distribution models and re-think their retail space requirements.

G&T has worked with a number of dealer groups, individual dealerships and OEMs over the years, providing us with valuable insights with regard to the disruptions that automotive retail and the traditional dealer model face. We work closely with our clients, helping them to deliver new retail concepts and strategies as they make the transition towards a digital future.

To discuss your particular project requirements or to find out more about how G&T can help you, please contact us.