Blockchain technology appears to be here to stay and its use cases go far beyond cryptocurrencies. It has the potential to offer immense opportunity for the construction industry to become more effective, transparent and productive. But what is it and how can the construction sector harness its potential? Senior Associate, Martin Carter, discusses the possible benefits from contracts and payments to supply chain and logistics, BIM to asset lifecycle management. Martin offers his insights into how blockchain could disrupt the entire industry.

In the first of a series of three articles about blockchain, Martin will discuss how blockchain is enabling new methods of payments and financing of real assets using smart contracts and decentralised finance applications and the potential opportunities they present to improve cashflow and liquidity in the construction industry.

Blockchain Explainer

Blockchain is most widely known as the underlying technology that powers the cryptocurrency Bitcoin. Developed and launched by the pseudonymous developer Satoshi Nakamoto in 2008 after the release of the white paper “Bitcoin: A Peer-to-Peer Electronic Cash System”, the technology enables secure, trustless, peer-to-peer recording of transactions through a decentralised network that runs on the internet.

There has been much hype around the potential of the technology to transform industries, including construction. In 2018, the Institution of Civil Engineers (ICE) released a paper “Blockchain Technology in the Construction Industry – Digital Transformation for High Productivity” that explored the potential applications for blockchain in the construction industry. These applications include:

- Payments and project management

- Procurement and supply chain

- BIM and smart asset management

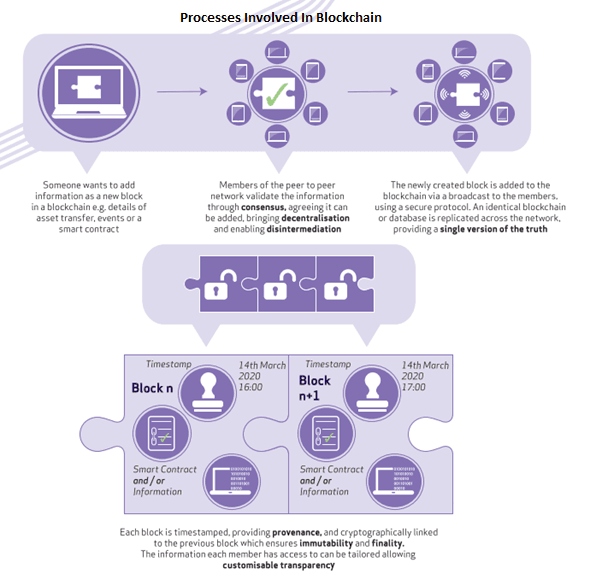

Blockchain is a distributed digital ledger technology that allows for secure and transparent transactions without the need for a central authority or middleman. It was initially introduced as the technology underpinning the cryptocurrency Bitcoin but has since been adapted for a wide range of applications.

At its core, a blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block contains a unique code, called a hash, which is generated based on the data it contains and the hash of the previous block in the chain.

Once a block is added to the chain, it cannot be altered without invalidating the entire chain. This makes the blockchain resistant to tampering and fraud, as all participants in the network have a copy of the ledger and can verify the integrity of the transactions. They have the potential to revolutionise the way we store and exchange information, as they enable secure and transparent transactions that can be conducted without the need for intermediaries.

Source: Blockchain_Report.pdf (cpcatapult.wpenginepowered.com)

Bitcoin

The traditional ‘centralised’ method of sending money from one person to another in a ‘trusted’ way requires a financial intermediatory to create and keep a track of bank balances and account details and process payments through centralised systems for clearance and settlement. If your payment is cross border, it will also likely go through the SWIFT messaging system. Bitcoin was developed to remove the need for these systems.

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Bitcoin is decentralised, meaning that it is not controlled by any central authority or government and transactions are processed on a distributed ledger called the blockchain.

Bitcoin is created through a process called mining, in which powerful computers solve complex mathematical problems and are rewarded with new bitcoins. There is a limited supply of bitcoins, with a maximum of 21 million that can ever be created and the supply is gradually released over time.

Bitcoin can be sent and received between users through a peer-to-peer network, without the need for intermediaries such as banks or payment processors. Transactions are recorded on the blockchain, which is a public ledger that contains a record of every Bitcoin transaction that has ever occurred.

Bitcoin has gained popularity due to its decentralised nature and its potential to provide financial freedom and privacy. It has also been subject to controversy due to its association with illegal activities and its potential to be used for money laundering and other criminal activities. In addition, Bitcoin uses a ‘proof of work’ mining mechanism to validate transactions on the network which uses vast amounts of computing power (and thus energy). This has led to concerns around its environmental and sustainability credentials. According to the Cambridge Centre for Alternative Finance (CCAF), Bitcoin currently consumes around 110 Terawatt Hours per year — 0.55% of global electricity production, or roughly equivalent to the annual energy draw of small countries like Malaysia or Sweden.

In addition to being used as a digital currency, Bitcoin has also inspired the development of other cryptocurrencies and blockchain-based technologies. Bitcoin is currently the largest cryptocurrency by market capitalisation and is accepted by merchants and businesses around the world as a form of payment.

Smart Contracts

Smart contracts are self-executing contracts that are stored on a blockchain and automatically enforce the rules and obligations written in the contract. They were first introduced on the Ethereum blockchain but can now be found on many other blockchain platforms as well.

Smart contracts are stored on the blockchain. They contain the terms of the agreement between two or more parties and the conditions under which the agreement will be executed. Once the conditions are met, the smart contract is automatically executed without the need for intermediaries.

The execution of smart contracts is based on a set of rules and conditions that are written in code. For example, a smart contract between two parties for the sale of a product might contain rules specifying the conditions under which the product will be delivered and the payment will be made. If both parties agree to the terms and conditions, the smart contract will be executed automatically when the conditions are met.

Smart contracts have several advantages over traditional contracts. They are transparent, secure and tamper-proof, as they are stored on the blockchain and cannot be modified once deployed. They also reduce the need for intermediaries, such as lawyers and notaries, which can reduce the cost and time required to execute the contract. They are a powerful tool for creating automated, trustless transactions that can reduce costs, increase efficiency and improve transparency.

In construction, smart contracts will facilitate automated decision making for contractual entitlement. By using Oracles (which pull off-chain data on-chain), on-site data can be transmitted by sensors and used by smart contracts to automate the agreement of variations. One example would be the use of weather data to agree on Compensation Event entitlement under the NEC suite. Others could be the use of temperature sensors in bitumen delivered to the site to sign off technical compliance or linking BIM models containing as built data to progress payments.

Smart contracts have the ability to process payments on a second-by-second basis, meaning clauses such as Liquidated Damages provisions can be ‘streamed’ in real time from one party to another, or progress payments can be passed in real time down the contractual chain bringing huge improvements to cashflow and liquidity that has historically been the downfall of the industry.

Case Study - Ethereum

Ethereum is an open-source, decentralised blockchain-based computing platform that allows developers to build and deploy decentralised applications (dApps) on its blockchain. It was launched in 2015 by Vitalik Buterin, a cryptocurrency researcher and programmer. One of the main differences between Ethereum and Bitcoin is that while Bitcoin is primarily a digital currency, Ethereum was designed to be a more versatile platform that allows developers to create and run decentralised applications on its blockchain. Ethereum uses a smart contract programming language called Solidity, which enables developers to create custom contracts and execute them automatically without the need for intermediaries.

Ethereum's native cryptocurrency is called Ether (ETH), which is used to facilitate transactions on the Ethereum network and incentivise developers to build and maintain dApps on the platform. Ether is also used to pay for transaction fees and computational services on the network.

Ethereum has become one of the most popular blockchain platforms for building decentralised applications and its use cases extend beyond just digital currency. Some examples of Ethereum-based dApps include decentralised exchanges, prediction markets and blockchain-based games. The Ethereum platform also supports the creation of other cryptocurrencies and tokens through its ERC-20 standard, which has led to the creation of thousands of new tokens on the Ethereum network.

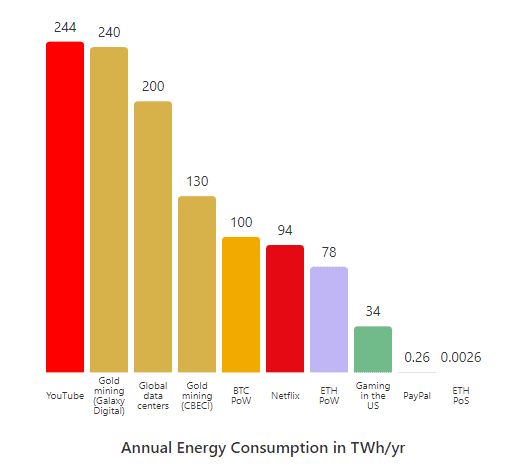

In 2022 Ethereum transitioned from using a ‘proof of work’ consensus mechanism to a ‘proof of stake’ method of validating transactions and securing the network. ‘Proof of stake’ mechanisms don’t require complex mathematical problems to be solved, which means that the energy consumption of Ethereum is now 99.9% less than that of the Bitcoin blockchain, significantly enhancing its sustainability credentials.

The chart below shows the estimated annual energy consumption in TWh/yr for various industries. Ethereum annual energy consumption is now at 0.0026 TWh/yr under the Proof of Stake (PoS) mechanism versus 78 TWh/yr under the previous Proof of Work (PoW) method.

Stablecoins and Emerging Regulation

Stablecoins are a type of cryptocurrency that are designed to maintain a stable value relative to a traditional currency or asset, such as the US dollar, the Euro or gold. Stablecoins aim to provide the benefits of cryptocurrencies, such as fast and low-cost transactions, while minimising the volatility that is often associated with traditional cryptocurrencies like Bitcoin.

There are several types of stablecoins, including those that are backed by fiat currencies (ie government-issued currency that is not backed by a commodity such as gold), those that are collateralised by cryptocurrencies and those that use algorithmic mechanisms to maintain their stability. Fiat-backed stablecoins are the most common and they are typically backed by reserves of the fiat currency that they are pegged to. A prominent example is USD Coin (USDC) which is issued by Circle, a crypto company with institutional backing from Blackrock and key institutional partners such as Visa and Mastercard. USDC is primarily minted as an ERC-20 token that runs on the Ethereum blockchain and is available on other emerging blockchain platforms.

Stablecoins have become increasingly popular in recent years and their use cases have expanded beyond just cryptocurrency trading. They are now used for cross-border payments, remittances and as a store of value, among other things. Stablecoins would benefit the construction industry on a number of levels once they are issued for all major currencies. For example, hedging of currency fluctuations for overseas plant and materials would become easier to manage by the nature of real-time smart contract payment provisions and currency exchange.

However, as stablecoins have become more popular, regulators around the world have become increasingly concerned about their potential risks to financial stability and consumer protection. In particular, regulators are concerned about stablecoins that are not backed by traditional assets or that have unclear governance structures.

In the United States, the Securities and Exchange Commission (SEC) has taken an active role in regulating cryptocurrencies. In December 2020, the SEC filed a lawsuit against Ripple Labs, alleging that the company had conducted an unregistered securities offering by selling XRP, a cryptocurrency that the SEC claims is a security rather than a currency. The SEC's lawsuit against Ripple has raised questions about the regulatory status of other cryptocurrencies, including stablecoins.

In addition to the SEC, other US regulators have also expressed concerns about stablecoins. In November 2021, the US Treasury Department's Office of the Comptroller of the Currency (OCC) issued an interpretive letter stating that national banks and federal savings associations could use stablecoins to facilitate payment activities and other bank-permissible functions. However, the OCC also noted that stablecoins must be backed by assets that are "permissible investments" for banks and must comply with anti-money laundering and other regulatory requirements.

Internationally, regulators have also expressed concerns about stablecoins. In 2019, the Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system, issued a report on stablecoins. The report noted that stablecoins could pose risks to financial stability, particularly if they were to become widely used and then suddenly fail. The FSB recommended that stablecoins be subject to the same regulatory standards as other financial assets.

The European Union has also been active in regulating stablecoins. In September 2020, the European Commission proposed a new regulatory framework for cryptocurrencies, including stablecoins. The proposed framework would require stablecoin issuers to obtain authorisation from regulators, provide regular reports on their activities and adhere to strict prudential and conduct standards.

In April 2022 in the UK, then Chancellor Rishi Sunak set out the UK Government’s vision to make the UK a global cryptoasset technology hub. The vision states that “stablecoins [are] to be brought within regulation paving their way for use in the UK as a recognised form of payment.” Legislation to regulate stablecoins, where used as a means of payment, will be part of the Financial Services and Markets Bill, which was announced in the Queen’s Speech in 2022. The UK Government notes that “With appropriate regulation, they could provide a more efficient means of payment and widen consumer choice.”

In conclusion, stablecoins are a rapidly growing sector of the cryptocurrency industry and they have the potential to revolutionise the way we make payments and store value. However, as stablecoins become more popular, regulators are becoming increasingly concerned about the potential risks that they pose to financial stability and consumer protection. As a result, stablecoins are likely to face increased regulation in the coming years.

Decentralised Finance (DeFi)

Decentralised Finance (DeFi) is a system of financial applications built on top of blockchain technology that aims to create an open, permissionless and transparent financial system without relying on traditional financial intermediaries like banks or other financial institutions.

DeFi applications allow users to access financial services such as lending, borrowing, trading and investing in a peer-to-peer manner. These services are facilitated by smart contracts, which are self-executing code on the blockchain that automatically enforce the rules of the contract without the need for intermediaries.

One of the key features of DeFi is its decentralisation. Instead of relying on a central authority, such as a bank or a government, DeFi applications are built on top of decentralised blockchain networks, such as Ethereum. These networks are maintained by a community of users who collectively validate transactions and maintain the integrity of the network.

DeFi applications are also designed to be open and transparent. The code that powers DeFi applications is typically open source, meaning that anyone can review and contribute to it. Transactions on the blockchain are also public and transparent, allowing users to verify that their transactions are being executed correctly.

DeFi offers several advantages over traditional financial systems. For example, DeFi applications can operate 24/7 without the need for intermediaries, making them more accessible to users around the world. They also offer greater transparency and lower transaction fees compared to traditional financial services.

There are several types of DeFi applications, including:

- Decentralised Exchanges (DEXs): These are exchanges that allow users to trade cryptocurrencies in a peer-to-peer manner without the need for intermediaries. DEXs are typically powered by automated market makers (AMMs) and provide users with greater control over their funds.

- Lending and borrowing platforms: These platforms allow users to lend or borrow cryptocurrencies without relying on traditional financial intermediaries. Users can earn interest on their deposited funds, while borrowers can access capital without the need for collateral.

- Stablecoins: These are cryptocurrencies that are designed to maintain a stable value relative to a traditional currency, such as the US dollar. Stablecoins are often used as a medium of exchange in DeFi applications.

- Prediction markets: These are markets where users can bet on the outcome of future events, such as the outcome of an election or the price of a particular asset. Prediction markets can be used for a variety of purposes, including hedging risk and gathering information about future events.

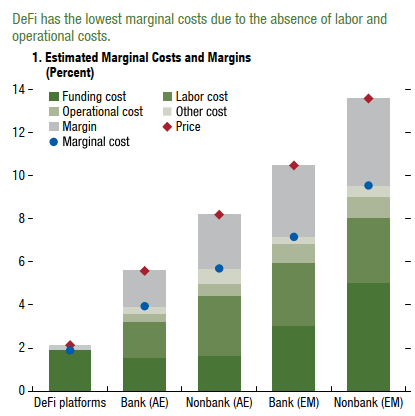

A report by the International Monetary Fund (IMF) in April 2022 into Global Financial Stability provides an analysis of the efficiency of DeFi platforms. The report estimated the marginal costs and margins (%) of DeFi compared to Traditional Finance (TradFi). The chart below shows that DeFi platforms are significantly more cost efficient than Banks and Nonbanks in both Advanced Economies (AE) and Emerging Markets (EM) due to the absence of labour and operational costs.

Enormous Potential

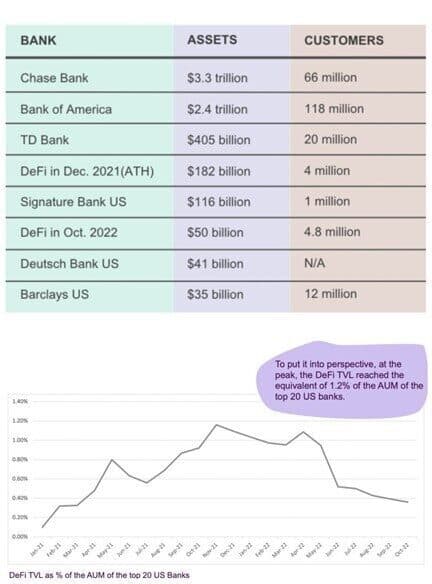

Total Value Locked (TVL) is a metric that measures the total value of cryptoassets deposited in DeFi protocols. At its peak, DeFi TVL was $182 billion which made it the 20th largest bank in the US. The ease of use of DeFi applications, when compared to the process of opening an account in a traditional financial institution has facilitated DeFi’s rapid expansion. Year-on-year growth in terms of wallets was over 100% in 2022 - continuing this trend would mean that DeFi would become a top ten US bank within two years.

Source: HashKey Capital

Real World Asset Financing

Until 2022, DeFi use cases so far have focused on serving participants from within the crypto ecosystem, however following the collapse of FTX centralised exchange in November 2022, the narrative has shifted and there is now a drive towards real world use cases such as lending to real world businesses and assets. DeFi lending protocols are now seeking to provide loans to finance real property - which could serve as the catalyst for the construction industry adoption of blockchain based payments, financing and the use of smart contracts.

Case Study - Maple Finance

Maple Finance is a decentralised finance (DeFi) protocol that provides blockchain infrastructure to facilitate capital markets moving on-chain. The platform is built on the Ethereum blockchain and uses a combination of smart contracts and a decentralised governance structure to provide the DeFi ‘rails’ for lending businesses to set up and run efficiently on the chain. It is the leading under-collateralised lending platform on Ethereum and has facilitated the origination of nearly $2bn USD in loans to date.

Maple Finance was launched in 2021 by a team of experienced Fintech developers and ex-institutional bankers. The platform is designed to address some of the key challenges facing cryptocurrency projects, including limited access to traditional financing and high collateral requirements for existing DeFi lending platforms.

One of the unique features of Maple Finance is its use of a credit delegation model. In this model, investors delegate their funds to a trusted credit delegate (a Pool Delegate), who then lends these funds to qualified businesses. The Pool Delegate is responsible for assessing the creditworthiness of the borrowers and underwriting the loans. In the case of default, loans are also enforced by off-chain Master Loan Agreements (MLA).

Real Property Financing

Icebreaker Finance has recently joined the Maple Finance platform as a Pool Delegate underwriting secured loans to businesses who are constructing bitcoin mining infrastructure (specialised data centres). This is one of the first credit facilities in the DeFi ecosystem that is lending to real world assets. The lending pool is denominated in USDC.

As DeFi continues to grow, it is also attracting the attention of regulators, who are working to develop regulatory frameworks for these new financial systems. However, the decentralised nature of DeFi presents unique challenges for regulators and it remains to be seen how DeFi will be regulated in the future.

What are the future implications for the Construction Industry?

The potential implications for the construction industry due to these new methods of payment and financing of construction projects are vast. These advances are also bringing new client verticals, whereby traditional lenders for construction and property developments will be complemented by DeFi lenders - who will also require off-chain services such as Development Monitoring and Assurance.

The potential for improved payment efficiency and lower cost transactions will lead to much needed improvements in cashflow to contractors lower down the supply chain, generally improving liquidity in the industry. When combined with Artificial Intelligence (AI), we may see the whole Project Controls arena shifting towards a data-driven, single source of truth fabric that will drive much needed improvements in productivity in the industry as a whole.

Blockchain technology has already been used to issue bank guarantees on-chain by Australian consortium Lygon – consisting of the Commonwealth Bank of Australia (CBA), ANZ, Westpac, Scentre Group and IBM. This solution runs on a private blockchain called Hyperledger and reduces the typical timeframe to create and issue a bank guarantee from 30 days to 1 day and removes the potential for fraud that paper-based guarantees present. Further, the use of blockchain and smart contracts present the opportunity to bring Project Bank Accounts (PBAs), facilitated by standard contract forms such as PPC2000, JCT and the NEC, on-chain. PBAs can be slow to set up and be an administrative burden-their blockchain based equivalents will speed up payments and provide increased transparency to project participants.

Utilising the composable nature of decentralised applications and blockchain technology, future developments in smart contracts could change the nature of construction contracts. ‘Smart legal contracts’ are already being developed and trialled by FIDIC and other standard form contract bodies. When adopted on a wider scale, this will lead to a requirement for new contract management and administration processes within the industry that augment the new blockchain based contracts.

In the next article in this series, we will dive deeper into ‘Smart legal contracts’ and how blockchain can enable new commercial value frameworks to deliver construction projects more transparently and efficiently in the future.