STOP PRESS – 25th MAY 2021

In a welcome change of policy the Government has tabled an amendment to the Finance Bill which would remove the leasing restriction that would have applied to plant & machinery in leased property. This change should enable property investors to claim Super Deductions (130% for main pool plant & machinery and 50% for special rate pool plant & machinery) on all background plant & machinery leased with a building rather than only on assets in central and common areas of multi let buildings. This is a positive move which will help achieve the Government’s aim of an investment led recovery.

Since the announcement of Super Deductions (130% for main pool plant & machinery and 50% for special rate pool plant & machinery) in the Budget there has been some uncertainty regarding the extent to which these would be available to property investors. Having seen the draft legislation, our concerns were that:

- Super Deductions would not be available on plant & machinery which is leased as part of a building.

- Super Deductions would not be available to companies investing in property through a partnership.

Having raised these concerns with HMRC we have now been advised as follows:

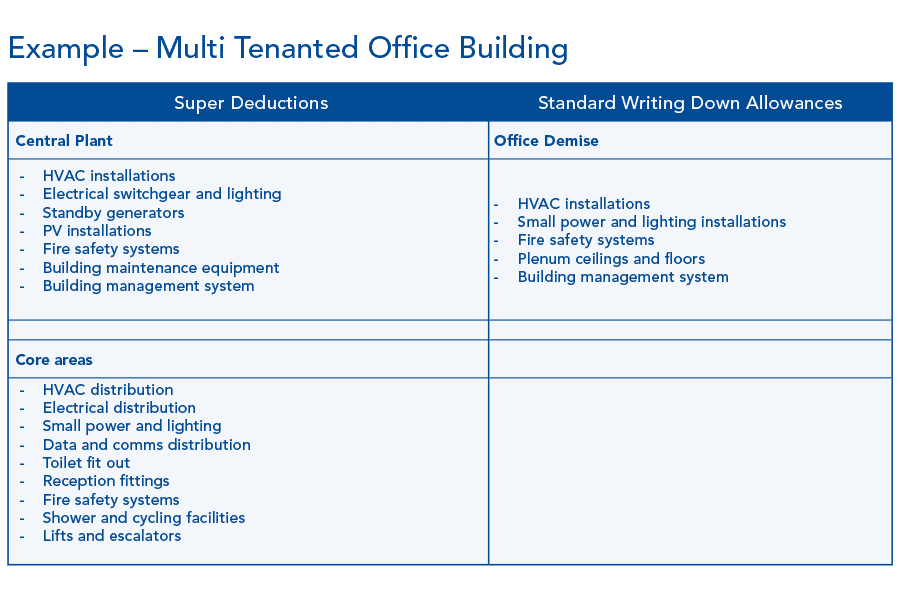

Plant & machinery for leasing – In contrast to previous first year allowances, plant & machinery which is leased as part of a building will not qualify for the Super Deductions, however HMRC is making a distinction between plant & machinery which is within a tenant’s demise and that which is in central plant rooms and core areas of multi-let buildings. The latter being provided for use by the tenants but not leased to them. Whilst they have stated that claims must be looked at on a case by case basis, the intention appears to be that only plant & machinery within the areas demised to the tenants will be excluded from the Super Deductions but other plant & machinery included in the building will qualify.

Whilst it is welcome news that Super Deductions will not be completely excluded for lessors, this will add a further layer of complexity when preparing capital allowances claims on construction expenditure. It will also still leave some uncertainty as to what might happen if the tenancy situation changes after a claim for Super Deductions has been made. It is not too difficult to imagine a situation where a building is available for letting to multiple tenants but ultimately is let wholly to one tenant after a Super Deduction has already been claimed.

Companies investing through a partnership – on this point HMRC has advised that they will not look through the partnership structure to the taxpaying status of the individual investors and Super Deductions will therefore not be available in this situation.

No doubt more questions will arise as we enter the new world of Super Deductions and we will provide further updates in due course. In the meantime if you have any questions or queries as to how this may affect your project then please feel free to contact us.

If you have any questions about this report, please contact Jared Carver, Chris Ranson or Neil Swarbrigg