Q4 2022

Input Costs

Key inflationary and deflationary pressures

Looking at independently produced raw input cost inflation metrics from the BCIS, it is clear that materials and plant have been biggest drivers of inflation throughout 2022.

Driven by the red diesel ban and higher fuel costs, the BCIS Plant Cost Index has risen by more than 31% in the first three quarters of 2022 alone. Fortunately, plant typically accounts for less than 3% of the total construction cost on a commercial project so the total weighted impact has been less significant than materials, for example. The BCIS Materials Cost Index is expected to rise by c.12% in the 2022 calendar year (Jan-Dec 2022) and with materials accounting for c.57% on a typical commercial office project, this has been the real driver of input cost inflation in 2022.

At an estimated 5.3% for the year, labour inflation has lagged both the BCIS’ materials and plant inflationary indices but is forecast to see a significant step change from late 2023 as wages catch up with broader inflationary trends and higher costs of living.

With the exception of labour, all BCIS input cost indices show that inflation in the construction sector was heavily sacked or front-loaded in the first half of 2022. In fact, the vast majority of all input inflation in 2022 occurred in a single quarter (Q2) following the disruption that ensued from Russia’s war with Ukraine. With the initial supply shock now over and supply chains having had time to adapt and adjust, inflation is set to drop across all three key BCIS input cost indices in Q4.

Depending on how these raw input costs are weighted (in terms of their elemental contribution to total construction cost) across sectors, building, and project types, certain schemes will have experienced inflation well in excess or even below our UK average TPI forecast of 5.5%. It is therefore important to bear in mind that G&T’s figure is an indicative average across all sectors and project types. However, with G&T’s diverse project mix, the latest set of TPI forecasts for 2022 are reflective of the broader construction cost inflation movements.

Based on our observations of the market in tender returns, survey feedback and our extensive discussions with the supply chain, we have established that a number of inflationary and deflationary pressures are likely to impact tender pricing. Many of the pressures from our previous TPI report continue to impact tender pricing, but recent macro-economic developments may act to partly offset these prevailing inflationary pressures.

Material Costs

Material prices have undoubtedly been the main driver of construction cost inflation so far in 2022, as manufacturers successfully passed on rising production costs and commodity price increases down the supply chain.

However, material prices appear to have turned a corner, as evidenced by the BEIS’s ‘All Work’ material price index falling by a notable 1.42% in August. This was the first monthly fall in material price inflation since July 2020 – the point at which demand started to come back online within the UK construction sector and material price inflation began its rapid ascent, fuelled by global supply-demand imbalances.

Will this mark the beginning of a much-anticipated cooling of material price inflation? A lot depends on energy price movements. Russia’s decision to shut off gas supply to the European Market via the Nord Stream 1 pipeline in September stoked a further energy price spike, but EU gas prices (as reflected in the Dutch TTF Gas benchmark) have since dropped to three-month lows (of c.€150 per megawatt-hour) due to an improving supply outlook.

LNG flows to northwest Europe are at their highest seasonal levels since 2016, as shipments continue to arrive from US and Qatar. Gas Infrastructure Europe says gas stocks have reached 98% in France, 94% in Germany and 92% in Italy – enough to get through the winter. Temperatures also remain higher than forecast which has seen declining demand from both industry and households.

Gas prices still remain exceptionally high compared to a year ago (€38 per megawatt-hour in October 2021) and this has meant that parts of the European industrial sector have been forced to cut production hours due to the energy crisis. However, the short-term outlook at least is now far more positive. The likes of Goldman Sachs has forecast gas prices to drop even further to below €100 per megawatt hour by the end of Q1 2023 due to “gas demand destruction” and high gas inventory levels, which bodes well for energy-intensive materials in 2023.

Falling energy prices will particularly help sectors that have a higher level of exposure to heavy-side, energy-intensive construction products and materials (eg infrastructure and industrial warehousing), but because manufacturers buy energy in advance via fixed-price energy contracts over set periods, falling wholesale energy prices will take time to trickle down through to product pricing strategies. Furthermore, the fall in the value of pound will inhibit any trickle-down effect of lower wholesale energy prices as oil and natural are traded in the strong US dollar on the global energy markets.

Some key construction materials have surpassed the decline experienced by the broader BEIS ‘All Work’ material price index. After peaking in June, structural steel, rebar and imported wood have all fallen by more than 12%. However, September will likely experience a further upward spike in steel prices following the knee-jerk reaction in the energy markets to Russia’s cut off of Nord Stream 1 pipeline gas supply. Indeed, both British Steel and ArcelorMittal put out two separate price increase notifications for structural steel sections shortly after energy prices shot up in August, citing cost pressures in the production of and transportation of steel. This reflected a total increase of £250 within the space of a month.

Through eight months of activity (Jan-Aug 2022) and with 1.25 billion metric tons produced, global steel output for 2022 is down by 5% year-over-year compared to 2021. The fall in production reflects weakening industrial demand globally, rising energy costs, as well as complicating factors such as the Russian invasion of Ukraine. The global economy is cooling in light of what are widely acknowledged to be the toughest conditions outside of pandemic lockdowns and since the global financial crisis. Goods-producing industries, including construction, are starting to see falls in real-terms spending amid increased global economic uncertainty. Inventory reduction polices and destocking are even becoming more common in many countries.

Changes in demand conditions typically bring about price corrections. Global output contracted for the second straight month in September – a trend being mirrored in the domestic UK construction market. Future output expectations have also diminished according to the CPA. In tandem, cost pressures are moderating. While material price inflation is clearly still an issue, early data (through PMI surveys and public data sets) and a sense among the construction supply chain points to a near peaking of material price inflation.

Labour

Construction continues to try and boost capacity by increasing staffing levels amid greater workloads and ongoing efforts and reduce backlogs. However, firms continue to cite a shortage of candidates to fill vacancies, creating a strong upward pressure on wages.

ONS data suggests that average weekly earnings in the construction sector rose by 4.4% in the year to August 2022 – significantly higher than the long-term annual average growth rate of 3%. While labour has been the least inflated construction input cost in 2022, G&T and other independent forecasters anticipate a step change 2023 that will see labour take over as the biggest driver of tender price inflation and lead the charge.

With no immediate solution to the tight construction labour market and a cost-of-living crisis sustaining upward pressure on wages, labour looks set to continue its role as a long-term inflationary driver.

The latest Construction Skills Network (CSN) report points to an additional 266,000 construction workers being required by 2026 in order to meet demand (the equivalent of 53,200 workers per year, and up from a 2021 figure of 43,000). The process of recruiting and developing a highly skilled workforce was recently described by the Tim Balcon, CEO of the CITB as, “…by far the construction industry’s biggest challenges over the next five years.”

The largest increases in annual demand will be for occupations such as carpenters/joiners and construction managers, along with a range of technical roles. These include electronics technicians, civil engineering technicians, estimators and valuers, as well as office-based support staff. All nine English regions, as well as Scotland, Wales and Northern Ireland, are expected to experience growth resulting in increased demand for workers over the 2022-2026 period. Strong demand in the private housing, infrastructure and repair & maintenance sectors are expected to be the main drivers of recruitment activity over the period.

Depending on the severity and extent of any economic slowdown over the next year, future growth projections for the industry may be temporarily reined in. However, this is unlikely to impact the CSN’s recruitment requirements significantly over the longer-term and will be difficult to meet without introducing greater flexibility into the UK’s current worker immigration policy or substantial investment into training and skills development. Despite signs of an imminent economic cooling, construction vacancies remain at a near all-time high.

Job vacancies in the sector edged higher in the Jul-Sep period, reaching 45,000. This figure is some 94% higher than the 20-year, long-term average of 23,200 vacancies. Construction industry vacancies also bucked the national trend, which saw vacancies in the Jul-Sep period actually fall by 1%.

September’s UK PMI readings published by S&P Global suggest that the construction sector was the only key sector to see an overall growth in activity in the month. According to September’s report, the construction employment growth accelerated from August’s 17-month low, pointing to a strong rate of job creation. Strong, positive momentum in the sector is supporting employment growth for the time being but recessionary concerns could see a slowdown in the rate of job creation and vacancies.

Our TPI survey revealed that whilst projects on site are not generally experiencing labour shortages, some trade contractors have noted increased difficulty in securing labour. This has limited some subcontractors’ ability to submit tenders due to the risk of not having access to sufficient labour to fulfil the contract. Even with a weakening in demand and a reduction in forecast output growth, the tight labour market is unlikely to ease significantly. It will continue to be a major task for contractors to find fully skilled workers simply because these workers are currently available - they have either left the industry through retirement, emigration or choice.

Oncosts

On the whole, main contractor overheads and profit (OH&P) levels were unchanged over the past three months. OH&P levels for most incoming tender returns were within the usual/expected range and given that order books are full, most contractors will likely maintain their OH&P at current levels in percentage terms (albeit on projects that are of a higher value).

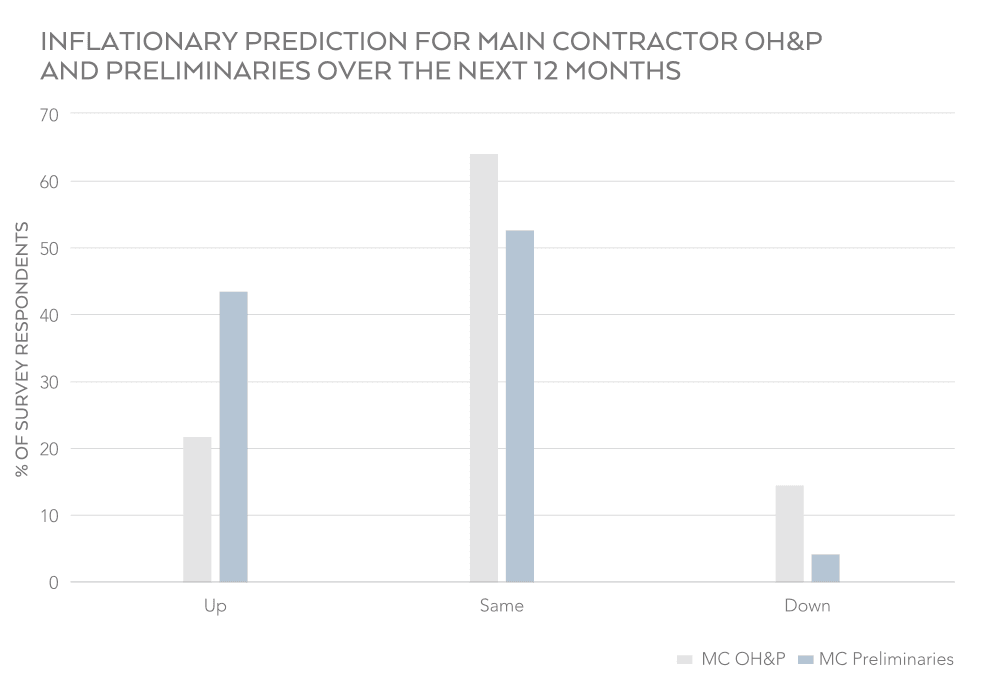

Just over 20% of our TPI survey respondents thought that OH&P would rise over the next 12-month period. Very few are expecting to see any downward trend in terms of OH&P levels, despite the prospect of sluggish economic growth. Beyond this though, as gaps in pipelines emerge and contractors become keener for work in the open market, OH&P levels may come off slightly.

More upward pressure is expected to be seen with regards to preliminaries costs. Labour costs are increasing as finding the right calibre of staff becomes increasingly difficult, while high energy prices will continue to impact the cost of operating plant on site. Rising insurance premiums will also be a contributing factor in pushing preliminaries higher.

Acting against some of these upward pressures on preliminaries costs will be the Government’s reversal of the National Insurance increase. This may provide contractor employers with a buffer that could be used to partially offset or absorb some of the other inflationary factors acting on preliminaries costs to win work in a more competitive tendering market.