The aviation sector has been hit hard as a result of the pandemic. Projects and expansion plans have been put on hold, cancelled or deferred for the foreseeable future, and many industry commentators are suggesting that activity in the sector will be negatively impacted for years to come.

Although there is still strong underlying demand for air travel, global quarantine policies arguably need to stabilise in order for confidence in travel to fully return. Greater predictability and harmonisation will be crucial in restoring demand and confidence to travel by air.

A more coordinated approach could dramatically improve the prospects of the aviation sector. Quarantine measures, which dramatically reduce demand for air travel, could potentially be replaced by better testing regimes at airports which would help unlock demand for air travel. Indeed, the latest International Air Transport Association (IATA) survey of passenger attitudes show that two-thirds of those surveyed in the UK supported a testing approach. The UK has the opportunity to shape global aviation policy and accelerate its recovery.

Lay of the Land

According to the Construction Products Association (CPA), 2019 was the high-water mark for aviation. After six years of falling output, construction work in the sector reached a five-year high in 2019 and, before the pandemic hit, output was forecast to continue its growth into 2020. Even when removing the Heathrow expansion from the equation, there was a strong pipeline of work. In early 2020, the CPA forecasted that aviation work would grow by 5% in 2020 and 3% in 2021. Rebecca Larkin, senior economist at the CPA, said that, “Airport expansion plans are in place at most airports around the country.”

Since then, airlines and airports have seen a substantive reduction in sales revenues and cashflow, with passenger numbers falling by more than 99% year-on-year in April (the first full month of lockdown) at some airports. Heathrow, for example, made a recent statement saying that provisional traffic figures for August 2020 show that passenger numbers remain 82% down on last year and that the unprecedented drop in numbers has cost the airport over £1bn since the start of March. As a result, Heathrow has seen a dramatic reduction in its revenues and is becoming increasingly cash constrained[1].

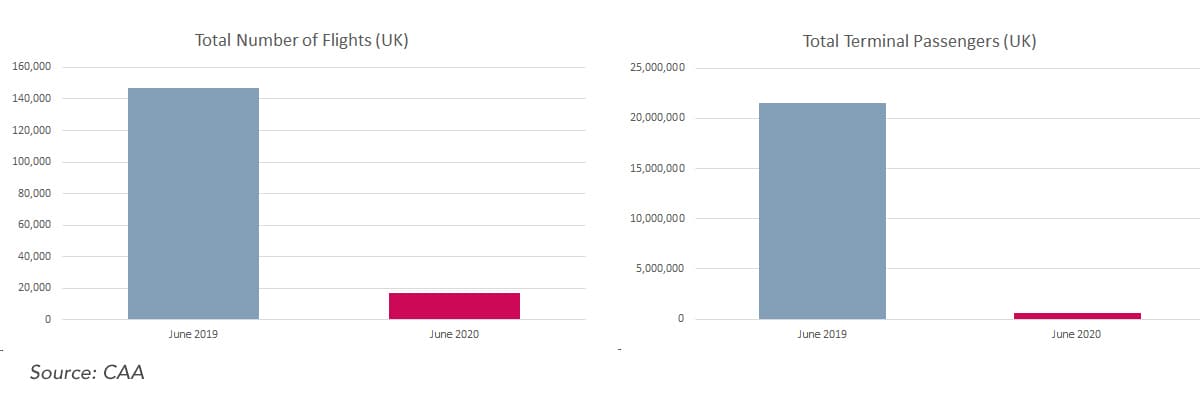

The latest airport data from the Civil Aviation Authority (CAA) for June 2020 shows little improvement, with both the total number of UK flights and terminal passengers falling well below normal volumes for this time of year. The total number of UK flights in June 2020 was 99.3% lower than the same month in the previous year. Total terminal passenger numbers has also been hit hard, falling by 97.4% in June 2020 compared to the same month in 2019.

Severely reduced passenger volumes and cashflow inevitably makes it more difficult for airports to pursue their pre-COVID 19 expansion plans. Due to the huge amount of capital spend required, most airport expansion projects have been suspended. A recent report[2] suggested that as much as £1bn of capital investment is now on hold. IAG, the owner of British Airways, has said that passenger numbers are unlikely to return to pre-COVID-19 levels until 2023, which challenges previous investment plans and demands a focus on what can be done to encourage a faster recovery.

The question being posed by many is that if reduced levels of activity persist in the long-term, will some existing airport facilities need to be repurposed? With subdued growth and development expected in the sector in the short-term, many operators are considering whether there may be opportunities to convert existing structures into non-aviation uses. Whilst no one can forecast the future, the industry is currently looking at what the sector can do with its infrastructure and aircraft in a shifting landscape.

Emerging trends

With capital programmes shrinking within the sector and limited potential for growth and development at the moment, airports will be heavily scrutinising any cost or time gains likely to be achieved from planned infrastructure projects or asset renewals in light of COVID-19.

Despite facing the potential prospect of a slow-paced and uncertain recovery, some pre-pandemic trends in the aviation sector, such as passenger automation and an increased focus on sustainability, will not be able to be ignored. Investing in infrastructure to enable passengers to have a ‘contactless’ journey through the airport will help give people the confidence to fly again. The technology for touchless baggage drop, check-in or biometric entry for example is not new, but there is now a clear use-case for deployment and a greater justification for the expense of installation. As touchless solutions develop further, the need for interaction is dropping away – prompting the need for new designs and new facilities that will support the new ‘norms’ of social distancing and minimising contact with both people and public surfaces.

The ACI and IATA jointly issued a paper[3] in May 2020 that lays out a pathway for restarting the aviation industry. A key focus was the push to transform the passenger journey, making it simpler, easier and quicker, but also to reassure the public that health and safety remain a priority. We have quickly gone from a trend of trying to accommodate a rising number of passengers to one of accommodating significantly lower volumes but with a new focus – making it touchless. Using voice and gesture sensors or introducing digital queuing systems, for example, will necessitate changes in airport design and layout and may provide opportunities. Ultimately, though, these technologies have to be paid for and operators will need to have more than a sense of hope that demand for air travel will recover.

An ‘anti-aviation’ green travel trend was gaining traction prior to the pandemic. Pre COVID-19 Heathrow lost support for expansion as the Government’s policy was not in alignment with the Paris Accord and was therefore ‘illegal’. However, the Court of Appeal’s decision to block the development of a third runway on climate grounds has been described by Heathrow as “eminently fixable”, confirming it plans to appeal to the Supreme Court. Regardless, the judgement has wider implications for keeping climate change at the heart of all planning decisions. The industry will need to demonstrate environmentally friendly solutions in future schemes and developments.

Until the end of October 2020, Heathrow will make do with just one runway. The airport is taking advantage of a lull in air traffic to conduct repairs on its southern runway. An increased focus on repair and maintenance work is more likely than expansion schemes until air passenger volumes (and revenues) recover.

Although we’re still a long way off all-electric commercial passenger aircraft, we’re beginning to see a future aviation industry that is not exclusively dependent on jet fuel. Fleet renewal cycles typically happen every 20-30 years and we still need to see a paradigm shift in battery technology and energy storage capacity before the aviation sector begins to seriously think about adapting or developing the ground infrastructure at airports to enable charging. Despite this, we’re rapidly moving towards greener air travel and aviation giants such as Boeing and Airbus are experimenting with electric motors and hybrid plane designs that use both electricity and fuel. These designs could potentially come to market within the next few years which would necessitate an expansion of essential support locations and associated infrastructure.

How much Government support does aviation get?

According to the Civil Aviation Authority (CAA), there have only been five years since 1950 where total passenger numbers travelling through UK airports didn’t increase. Prior to the pandemic, figures were projected to escalate throughout the 2020s. As such, the majority of individual airport masterplans in the UK were planning for growth above the 25% that the IPPC said the UK needed to limit growth to in order to reduce the UK’s emissions to net-zero.

The Government’s draft 2050 Aviation Strategy[4] says that is supports growth, but in a sustainable way where actions are taken to mitigate the environmental impacts. Building new terminals and runways are more politically delicate than other expansions such as those planned at Exeter and Bournemouth airports to build large-scale business parks and warehouses close to the airport in a bid to drive future capacity growth.

All expansion plans need to demonstrate that they are compatible with the Paris Agreement, but with reduced passenger numbers the focus has shifted from expansion to responding to the impacts of COVID-19. However, some airports, such as Heathrow, still appear to be planning for a future in which demand has recovered and the benefits of air travel have been restored. Having been granted permission to appeal against the block on a third runway, a spokesman from Heathrow airport recently said that in years to come, “...an expanded Heathrow will [still] be required.”

Gatwick, Stansted, Luton and London City all had expansion plans which have now been paused. Prior to the pandemic, some of these expansion proposals were rejected at the planning stage on environmental grounds (e.g. Stansted) but other airports have halted expansion plans post COVID-19. For example, the owner of London Luton Airport Ltd has been seeking permission to significantly increase its annual capacity from 18m to 32m passengers by 2050. The expansion proposals, which were due to be submitted to the Government in June, have now been shelved due to the massive decline in air travel demand making the plans untenable. However, the airport said that it is only delaying its plans and that it will consider submitting the Development Consent Order (DCO) in 2021 once there is greater clarity with regard to the Government’s policy on aviation carbon. Their plan is to go away and take a fresh look at every aspect of sustainability so that a low-carbon expansion can be achieved.

It’s evident that the Government needs to have a clear and unchallengeable aviation expansion policy. There has been a longstanding debate as to whether airports seeking to expand capacity can do so in alignment with the Government’s net-zero commitment. Plans that exacerbate the climate emergency are likely to be rejected whilst expansion that supports the UK aviation industry’s wider commitment to become a net-zero sector by 2050 will likely be approved.

New Opportunities

Despite revenues being so dramatically impacted, airports remain subject to high fixed costs. Heathrow has told the Government that it was losing £200m per month[5] by paying for policing and security, the maintenance of airfields and terminals, and pre-existing contracts. With no industry-wide support package provided to date by the Government, the cash-strapped UK airports may have to make alternative uses of their empty buildings.

Some have deliberated on the prospect of re-purposing elements of UK airports that are likely to be out of use for some time. Drawing on input and innovations from developers and the consultant community, operators may consider how these underutilised buildings can generate new and alternative revenue streams. Prior to COVID-19, airports were deriving about 60% of their revenue from aeronautical charges (i.e. fees levied on airlines and passengers), whilst the remaining 40% came from non-aeronautical revenue (i.e. retail, parking and property development). A significant decline in air traffic is hitting aeronautical revenue streams particularly hard and operators may have to adapt their business models so that they are less dependent on air traffic.

In the short-term, airports could use their assets or infrastructure for other purposes such as extensive car parking or as distribution centres, making good use of their strong transport links. “Non-passenger related revenue” largely falls into two categories:

- Goods and services for local residents and employees

- Commercial real estate for local businesses

Catering for local communities will help airports maintain some revenue during turbulent periods and unexpected events that prompt declines in passenger-related income.

Longer-term, if/when demand recovers and if social distancing concerns remain, it’s quite likely that lounge and concession areas will need to be re-thought and re-designed to encourage physical distancing. Spacing and layout will need to be considered carefully at check-in desks and departure lounges to reassure passengers – enabled by the technological advances in passenger automation and baggage handling.

Additionally, linkage to public transport will be essential in achieving sustainable development enabling a modal shift from private cars. The subsequent reduction in cars will result in less proportionate space required for car parking, providing further opportunities to repurpose the estate. Provision for new methods of onward travel such as autonomous vehicles and EVTOL vehicles (Electric Vertical Take Off and Landing) will also need to be considered.

Conclusion

With UK airports cutting capital expenditure significantly, expansion plans are likely to be considerably curtailed or deferred. Although some airport operators have said that non-essential work will be put on hold, others (such as Manchester Airports Group) have not made any decision on their capex plans. Contractors such as Morgan Sindall have reported that its aviation division had seen a “significant and immediate reduction in all current and future planned activity”, reflecting the new reality that it could be some time before many airport expansion projects can really be justified by a recovery in demand for air travel.

Although contractors may have to scale down their aviation work in the coming years, there are still opportunities in the market. The opportunities may be on a smaller scale whilst demand recovers, but the substantive built assets require ongoing investment and, in the long-term, operators still appear keen to pursue their expansion plans. How and when these plans are pursued will, by-and-large, be driven by demand and the Government’s sustainability agenda.

[1] https://www.theguardian.com/uk...

[2] https://www.constructionnews.c...

[3] https://store.aci.aero/form/sa...