Developing our own unique approach to everything is part of the UK’s DNA. As such, making the transition from internal combustion engines (ICE) to electric vehicles (EVs) will inevitably require new ways of doing things, especially if EVs are going to contribute to the UK Government’s overarching policy to reach net zero carbon emissions by 2050.

Fundamental to increasing the uptake of EVs in the UK is ensuring that there is adequate charging infrastructure installed throughout. Although the expansion of charging infrastructure has been rapid, it needs to continue to grow rapidly to help the UK Government meet its ambitious carbon emissions targets.

Although access to convenient charging solutions is considered to be the number one priority in order to enable mass uptake of electric vehicles, it is only a priority if vehicle possession continues to be desirable. If we, as some anticipate, move towards more of an ‘on-demand’ transport service model, then vehicle availability becomes the priority and a very different infrastructure will be required. For example, people may rent their driveways and parking spaces to driverless car providers. Furthermore, if you don’t own the car, you won’t need to park it at work or the shops, so these could be used as charging stations where the driverless cars go to charge.

However, if we retain a car ownership/possession model, there will be more of a need for ‘home and away’ charging, which will form the most important requirement of a quick, comprehensive, publically available charging network where the consumer has a choice in terms of cost, speed and location of chargers. If an ‘on-demand’ approach takes off, then the consumer will want quick availability, fastest route understanding and probably occupancy options all managed by an App. Also, if there is less of a need to possess the vehicle, this creates a whole new dynamic, and the problem that 40% of the UK population does not have access to off-street parking for charging goes away.

In this article we explore how the need for ownership of EVs will influence the supply and delivery of charging infrastructure. We also identify some of the key challenges in providing a sufficient charging infrastructure to meet the forecasted demand.

The Current Situation

Successive governments have set their expectations around the private sector taking the lead in the provision of charging infrastructure. The Government’s overriding assumption is that the majority of recharging would likely take place at home and at the work place. On this basis, it considered that a publically available charging network would be underutilised and therefore uneconomic. However, a number of government-backed funds have been launched to help accelerate the roll-out of charging infrastructure by providing funding to new and existing companies that produce and install charge points. This includes the £400 million Charging Infrastructure Investment Fund.

In the absence of a centralised strategic and integrated approach for the large scale delivery of public charging infrastructure, local government authorities and the private sector have stepped into the breach. To date, the provision of charging infrastructure has been dominated by a range of charge point providers who have been incentivised by government finance to provide a range of open access, ‘away from base’ charge point solutions. Typical ‘away from base’ charging solutions include on-street residential charging, motorway and petrol station charging services, as well as public and shopping centre car parks.

Because private sector companies will always choose to install infrastructure in the most economically favourable locations, the majority of ‘away from base’ charging points have been installed in urban centres and transport corridors between urban centres. This has left large areas of the country without adequate charging infrastructure. Parallels can readily be drawn with the initial roll-out of broadband in the UK, where it was also left to the market to decide how and where to roll out full-fibre networks. As a result, early broadband suffered from an uneven distribution of infrastructure. For more information, see our recent report on the UK’s Fibre Optic Market. There is a risk that EV charging infrastructure will follow a similar fate. There are also a number of additional challenges when it comes to installing an evenly distributed charging infrastructure across the UK. For example:

- In urban areas, there is little off-road parking but usually high-density car possession, making urban areas more commercially attractive to private sector EV infrastructure companies

- In rural areas however, there is no shortage of off-street parking but car possession is relative, making these areas less attractive to the private sector to install charging infrastructure

- In new housing developments that fill the space between urban and rural, car possession will be high and, although there is provision for off-street parking, it is already insufficient to meet demand. Furthermore, most new houses have parking provision for two cars only and no charging capability other than a plug in solution inside the property

Charging

Home Charging

The average UK home consumes approximately 4,000 kWh electricity per year[1]. However, an EV with a 100kWh battery also will consume approximately 4,000 kWh/annum of electricity to drive 12,000 miles[2]. As such, a new housing development with 500 properties could need 4 megawatt-hours (MWh) per annum of capacity if each property had one EV. A total of 6 MWh/ annum would be needed if each property were to have two electric vehicles travelling at an average annual mileage[3].

Public Charging

The charge point provider market can be broken down into three types of organisations:

- Emobility Service Providers (ESMP)

- Charge Point Operators

- Charge Point Owners

ESMPs offer EV charging services to EV drivers, giving them access to a variety of charging points around a geographic area. They help drivers find charging stations, commence charging and pay with various mechanisms (ie card, app or other). Charge Point Operators operate a pool of charging points. Such organisations make sure the network works smoothly, including diagnostics, maintenance, price setting and data management. Finally, Charge Point Owners own the physical charging infrastructure.

Ubitricity (who specialises in lamp-post installations) and Ecotricity (who specialises in service station installations) are two ESMPs that offer a network of EV charging infrastructure up and down the country. EO Charging and Pod Point are typical charge point operators and are a combination of tech start-up and infrastructure providers. Such organisations offer a differing range of services from manufacture and supply only, through to full turn-key solutions (ie supply, design, installation, operation and maintenance).

The charging infrastructure supply chain

The UK currently has a total electricity generating capacity of 75.3 GWh[4] that it supplies to seven major sectors: industry, domestic, commercial, energy industries, public administration, transport and agriculture[5].

There are three levels of stakeholder involved in the distribution of the electricity, providing installation, operation and maintenance of the electrical infrastructure which help power our lives.

Distribution Network Operators (DNOs) are licensed companies that own and operate the network of towers, transformers, cables and meters that carry electricity from the national transmission system, distributing it throughout Britain. DNOs play a critical role in the charging infrastructure system. In the UK there are 14 DNO regions, operated by six DNO’s.

Independent DNOs (IDNOs) are licensed companies that own and operate smaller networks located within the areas covered by the DNOs. There are 13 IDNOs operating across the 14 DNO regions. IDNO networks are mainly extensions to the DNO networks that service new housing and commercial developments. The IDNOs are licensed to undertake works which interface with the DNO network and are also responsible for managing and operating their local networks, including all future maintenance and fault repairs.

An Independent Connection Provider (ICP) is an accredited company that builds electricity networks on behalf of either a DNO or an IDNO. The ICPs work closely with the DNO and IDNOs to ensure that the electricity networks are built to the required technical and quality standards. There are understood to be several hundred ICPs working on behalf of the IDNOs and DNOs across the UK.

The IDNOs and ICPs will therefore play a key role in the provision and installation of the electrical infrastructure that will be required to power the charge units and charge point locations across the country.

The Challenge

Consumers regularly cite the lack of convenient charging infrastructure as a significant deterrent when considering the purchase of an EV, along with time it takes to recharge and the driving range.

A key challenge to delivering convenient charging infrastructure is the limited power supply that many sites suffer from - a problem which is further compounded by the growing need for a network of ultra-fast chargers. As EV sales rise, so will the demand on both the transmission grid and distribution networks. It is understood that grid connections currently rule out almost one in four sites[6]. It is therefore not difficult to deduct that getting grid capacity to site is the most significant contributor towards cost and time in the delivery of charging infrastructure.

Determining whether or not a site has sufficient power capacity and the extent of electrical infrastructure upgrade works that may be required, are therefore two critical considerations in determining the feasibility of a particular site to provide charging solutions.

Installation of the electrical infrastructure, required to enable charging, becomes significantly more expensive and timely to deliver where works are required to upgrade the local distribution network.

New sites that aim to provide large numbers of rapid chargers require 2MW provision to meet their forecast electricity demand, which the DNOs are currently not able to meet. In response to this, the DNOs are preparing for significant change on their networks and how to manage the impact. For example, West Power Distribution has published an electric vehicle strategy which forecasts the number of chargers that will be required to connect to its network and also its ability to meet this demand from households, businesses and local authorities[7]. In urban areas with existing infrastructure, West Power Distribution indicates that there is capacity. For rural areas, however, it is less certain about its ability to meet forecast demand with its overhead network. Their strategy also outlines costs, lead times and related works required to install different types of chargers.

Integrating charging infrastructure within existing sites can also become problematic and hence costly. Issues commonly cited include space constraints for new parking, disruption during construction, operational traffic flows.

Charge Point Technology

As a disruptive technology, electric vehicle charging solutions can suffer from a number of challenges:

- An apparent lack of standardisation and accreditation available to installers, manufacturers and service providers

- Rapid changes in technology leading to obsolescence

- Rapid changes to the overarching regulatory environment resulting in changes to the electric vehicle charging market and end-user requirements

The development of the ‘car-to-charging interface’ has been left up to the vehicle manufacturers, which has resulted in a large number of different charging solutions. Charge point technology is currently defined by the following parameters:

- Power output (slow, fast, rapid, ultra-rapid)

- Supply type (AC, DC)

- Socket and plug arrangement (CCS, CHAdeMO)

Rapid advancements in charging technology means that technology can quickly become obsolete. In fact, some charging infrastructure installed only a few years’ ago is already redundant. Therefore, any site providing charge point solutions needs to not only cater for a wide range of different charge point technologies but also to future-proof against technological developments.

The Business Case

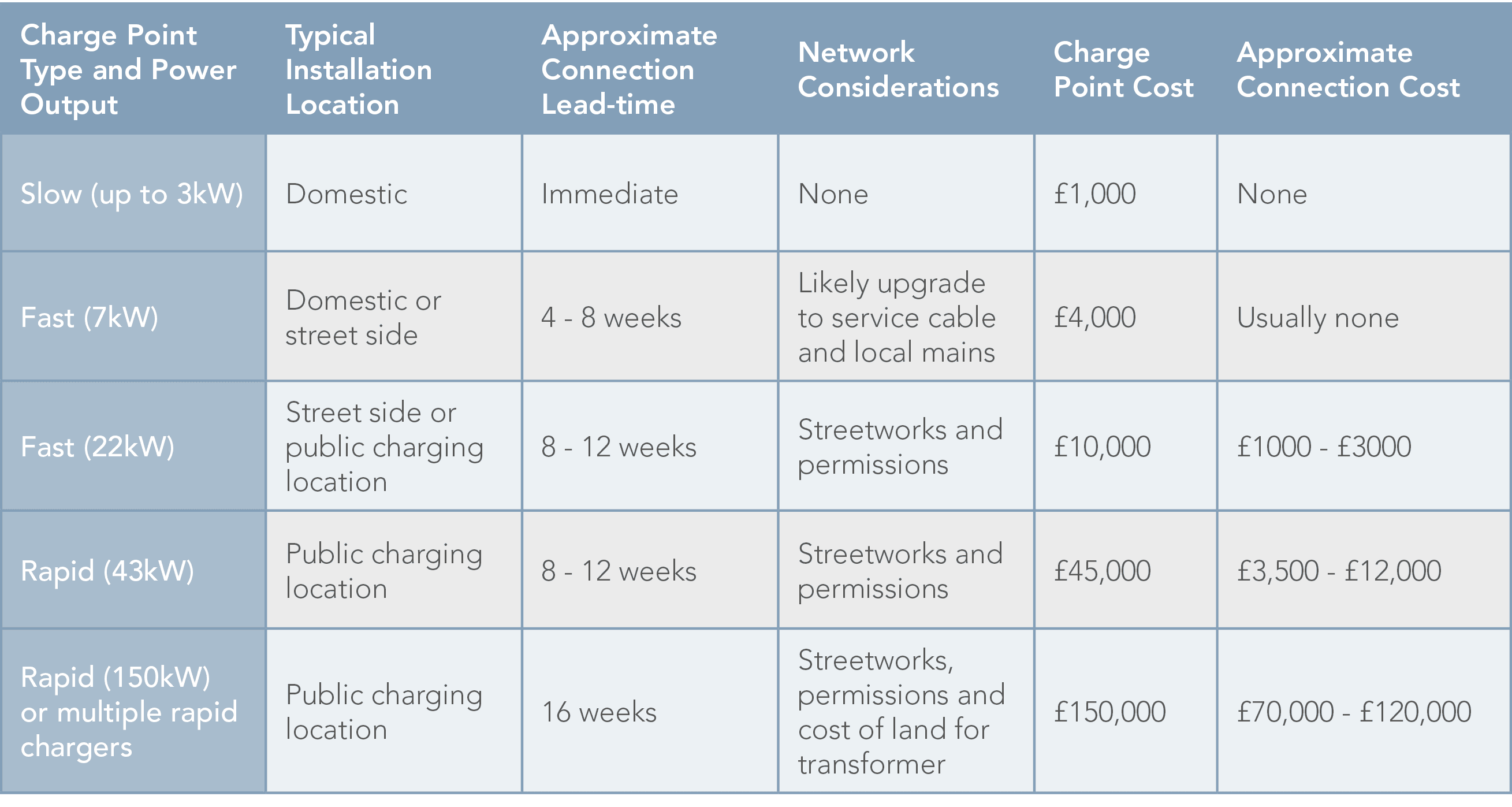

The typical capital cost breakdown for installing a new charging network are:

- The civil ground works associated with the installation of the below ground electric cables

- The final installation of the charging unit

- Any associated electrical equipment

Typical costs by charge point type are summarised below[8].

Ongoing costs associated with the day-to-day operation of charging infrastructure include electricity, rent, back-office, maintenance, damage/vandalism, customer service and enforcement and the potential loss of other revenue streams such as parking.

Generating a return on the capital investment and the ongoing operational costs will be determined by the charging services offered to the public/consumer. The three most common options are:

- Cost by energy delivered (kWh)

- Cost by time occupying the charger (minutes or hours)

- Set cost regardless of time or energy

The charging fee options will then be based on the charge type (slow, fast, rapid), where the charger is located and when it is used. At present, the recharging cost for an EV is lower than refuelling an ICE and is considered to be a significant enabler to the uptake of EVs. However, public recharging costs are at present low, meaning that there is a poor return from charging infrastructure capital investment and operational costs.

The Government has provided a range of different financial incentives to enable the installation of charging infrastructure. However, significant additional investment and probably a new approach is still required. As such, the ability to think laterally and to be creative when identifying alternative revenue streams will help make charging infrastructure more financially viable. This is another challenge that needs to be overcome if mass adoption of EVs (and the associated charging infrastructure) is to contribute to the UK’s carbon reduction targets.

The Opportunity

G&T is uniquely equipped to support a wide range of client organisations and supply chain partners in meeting this challenge and already sees a number of opportunities:

- Adapting existing infrastructure to reduce capital investment and generate new income streams. For example:

- Telecoms infrastructure could incorporate charging capability

- Industrial, commercial, transport sectors could utilise their assets and electrical capacity differently, ie Network Rail and TfL have land and good electricity distribution

- Landlords with staff car parks could incorporate charging capability and lease out to the general public.

- Some fleet operators are seeking to transition their fleet to EVs in response to the Government’s low carbon policy as well as their own energy and sustainability policies. Fleet operators not only require different charging speeds in order to balance needs and demand, but many could also face the challenge of finding charging solutions for staff who take their vehicles home at night and don’t have access to a private, home-based charging solution. Other users with large fleet operators are also looking to adapt their business models. If an existing hire car at an airport is currently hired out 90% of the time and takes 15-20 minutes between hires to valet, refuel and check, then the impact of having to plug in an EV to recharge for four hours is unsustainable. Either many more cars (and room to charge them) will be required or there will need to be significant power upgrades to provide ultra-fast charging.

- Facility owners, landlords and property developers are starting to install the necessary technologies and charging infrastructure to support the switch to EVs. They are futureproofing their estates and developments by retrofitting onto existing sites and providing passive provision for future expansion. The provision of charge points has become a popular way to attract new customers and improve their service offering, while providing benefits for their clients.

Conclusion

The ratio of EVs to publicly available charging infrastructure looks adequate for now, but this could change very quickly. For the first time in the UK, new EV and hybrid vehicle sales in the three months to June 2020 were greater than diesel vehicle sales. If this growth trend continues, the UK will need to invest heavily and rapidly to deploy sufficient charging infrastructure. The Society of Motor Manufacturers and Traders has calculated that £16.7bn needs to be spent to have enough charging stations for all new UK cars to become electric — the equivalent of 507 chargers installed per day between now and 2035[9]. Currently, the UK is falling short of this installation rate, with Zap-Map indicating that in the 30 days to 2nd October 2020, just 463 charging points were installed in the UK[10].

"We need to throw the kitchen sink at the issue of charging...We need to over-provide."

Because the Government has historically left it up to the market to determine where to build the charging infrastructure, we’ve ended up with a fragmented and disorganised national charging network. However, with the right support, a clearer strategy and closer partnership between the public and private sectors, the UK is more than capable of providing a convenient and cost-efficient solution to help overcome consumer concerns and ensure mass take-up of EVs, regardless of where you are in the UK[11].

Click here to download our case study on Electric Vehicle Charging Infrastructure

Click here for information on our work with Gigaclear

Footnote 2 = https://www.buyacar.co.uk/cars/1524/electric-car-economy-explained

Footnote 3 = One megawatt-hour (MWh) is equal to 1,000 kilowatt hours (kWh)

Footnote 4 = https://www.ofgem.gov.uk/ofgem-publications/76160/13537-elecgenfactsfspdf

Footnote 5 = One GWh or ‘gigawatt-hour’ is equal to 1,000 megawatt-hours (MWh)

Footnote 6 = https://www.westernpower.co.uk/smarter-networks/electric-vehicles

Footnote 7 = https://theenergyst.com/

Footnote 8 = Average costs taken from various sources

Footnote 9 = https://www.ft.com/content/b1e7102e-d5f9-40bb-bd87-c23476eedd10

Footnote 10 = https://www.zap-map.com/statistics/

Footnote 11 = https://www.theccc.org.uk/wp-c...