CONSTRUCTION AND PROPERTY HIGHLIGHTS

With the recovery from COVID-19 being the main focus of the Chancellor’s Budget there is a welcome shot in the arm for the construction and property industry.

Capital Allowances Super-Deductions and More

In a welcome move which will boost investment in property, as well as other sectors, the Chancellor announced a major increase in the tax relief available on plant & machinery.

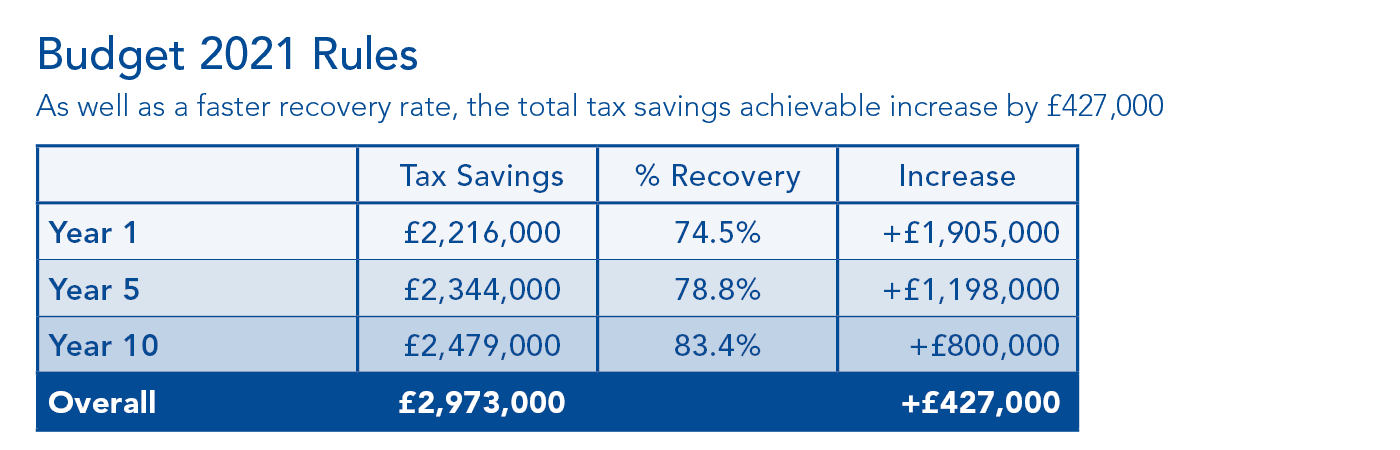

For the two-year period from 1st April 2021 to 31st March 2023, companies paying corporation tax will be able to claim a super-deduction of 130% on main rate plant and machinery and an enhanced first year allowance of 50% on special rate plant and machinery.

In the context of construction and property, main rate plant & machinery includes assets such as fire alarm and fire protection systems, building management and control systems, security and CCTV systems, building maintenance equipment, sanitaryware, fixtures, fittings, loose furniture and equipment. Special rate plant & machinery includes all the main services installations in a building including electrical power, lighting, hot and cold water installations, HVAC systems, lifts and escalators.

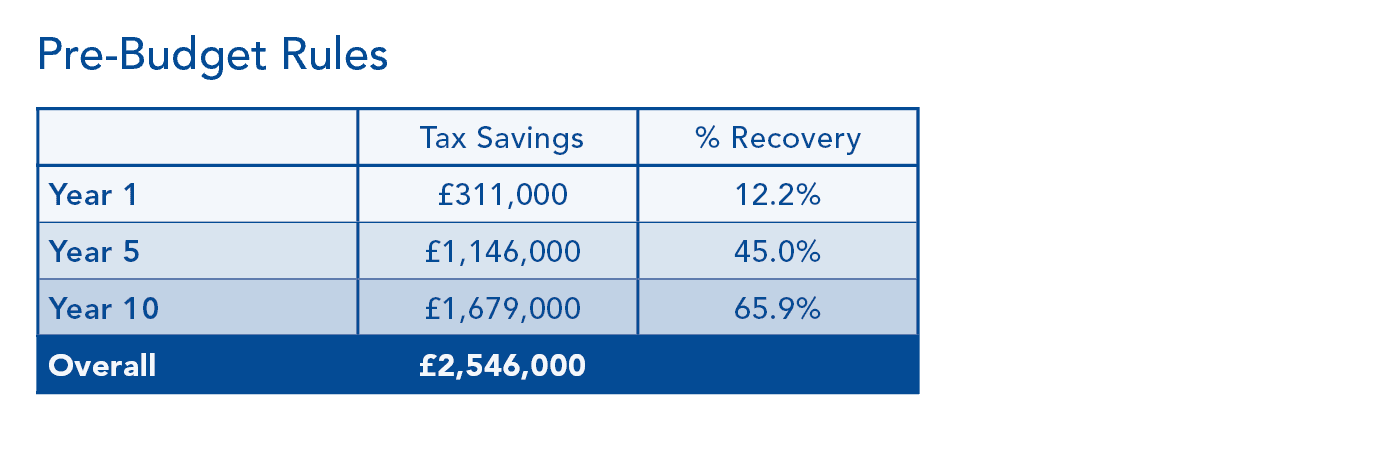

With these two categories typically accounting for 30% to 85% of the cost of a construction project, depending on the type of building and type of work being undertaken, this temporary increase will provide a significant boost to the tax savings available as shown in the example below.

Typical corporate £13.4m office fit out project

The devil as always is in the detail and there are a few important points to note:

- The super-deduction and enhanced first year allowance will only apply to companies paying corporation tax but this will cover most commercial occupiers.

- The increased rates will only apply to contracts entered into from Budget day (3rd March 2021) onwards, presumably so that it is a focused incentive for new investment rather than expenditure which is already committed.

- The measure applies only to new and unused plant and machinery so the purchase by an occupier of a newly constructed property from a trading developer should benefit from the increase.

- On a technical note, if the property is sold in the future then the disposal proceeds may trigger a balancing charge rather than an adjustment to the capital allowances pools. Joint elections under s.198 should still be effective though in minimising any such clawback.

* Post-Budget Note: Having reviewed the draft legislation it appears that in contrast to previous enhanced first year allowances the super-deduction and 50% First Year Allowance will not be available on plant and machinery that is leased as part of a building. We are seeking further clarification from HMRC on this point.

In addition to the above changes, the Government also confirmed that the temporary increase in the Annual Investment Allowance to £1million will continue to 31st December 2021 and therefore will give enhanced relief up to that value on investments in plant and machinery by non-corporate investors paying income tax.

Of course, with every silver lining comes a cloud and in this case the cloud on the horizon is an increase in the main rate of corporation tax from 19% to 25% from 1st April 2023. Timed to coincide with the end of the super-deduction this should provide further incentive to make the most of these enhanced tax reliefs while they are available and potentially create tax losses which can be carried forward to later periods when the tax rate will be higher.

Freeports

As part of a raft of business investment incentives and the overall theme of an investment-led recovery, the Chancellor announced the creation of eight new Freeports where businesses will benefit from increased rates of tax relief through capital allowances as well as stamp duty and business rates relief.

The Chancellor confirmed that within England East Midlands Airport, Felixstowe and Harwich, Humberside, Liverpool City, Plymouth, Solent, Teesside and Thames have been successful in their bids to become Freeports. It is our understanding that additional Freeports are also planned for Scotland and Wales.

The increased capital allowances relief in Freeports includes:

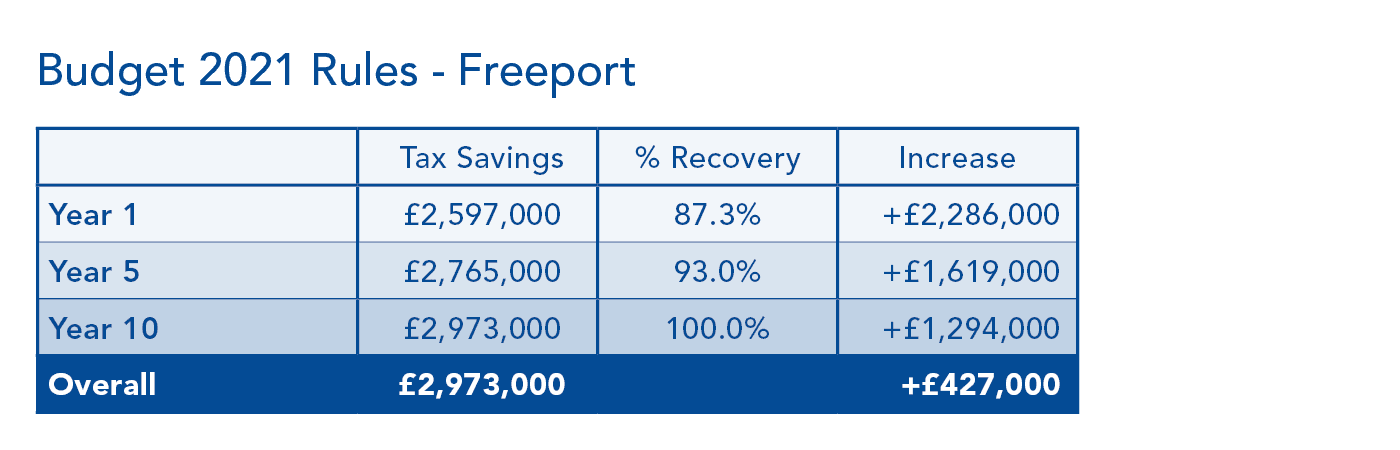

- 100% allowances for companies investing in plant and machinery. This will apply to both main and special rate assets, allowing firms to reduce their taxable profits by the full cost of the qualifying investment in the year it is made. The plant and machinery must be new or unused, be for the purpose of a qualifying activity and for primary use within a tax site within a Freeport. This measure is currently planned to be in place until 30th September 2026.

- A 10% rate of Structures and Buildings Allowance for constructing or renovating non-residential structures and buildings. This means firms’ investments will be fully relieved after 10 years compared with the standard 33 1/3 years at the 3% rate available nationwide. To qualify for the relief, the structure or building must be brought into qualifying use on or before 30th September 2026.

Whilst this is a welcomed measure, there will be a provision to clawback any enhanced capital allowance claimed if, within five years from its acquisition, the plant or machinery becomes primarily for use outside of a tax site of a Freeport area. It is anticipated that the above reliefs will be used in conjunction with the super-deduction whilst available. Using the same example as above, but with an office fit out within a Freeport, the increased benefits would be as follows:

In this instance all of the tax relief will be realised within the first 10 years.

Aggregates Levy Rates

Once more, the Government announced they would freeze the Aggregates Levy at £2/tonne. It would seem that the long-term intention to return the levy to index linking will take some time.

Landfill Tax

The Chancellor announced that the rates will increase in line with RPI. Therefore, from the 1st April 2021 the standard rate will increase from £94.15/tonne to £96.70/tonne and the lower rate from £3/tonne to £3.10/tonne. Uprating by RPI maintains the incentive to minimise the amount of material going to landfill and looking at other waste management options such as recycling and composting.

VAT Reverse Charge

1st March 2021 finally saw the introduction of the VAT Reverse Charge after a number of postponements. It applies only to transactions that are reported under the CIS and that are between VAT registered contractors and sub-contractors'. The intention is to reduce fraud within the sector. It is early days to see if this change will affect sub-contractors' cashflow, especially in the current pandemic.

This budget summary has been prepared from the Chancellor's Budget speech and supporting documentation. Budget proposals are subject to amendments during the course of the Finance Bill through Parliament. We have made every effort to ensure the accuracy of this publication but you should always obtain professional guidance before acting or refraining from any action as a result of its contents.

If you have any questions about this report, please contact Jared Carver, Chris Ranson or Neil Swarbrigg